- USD/JPY has been trading largely muted on the back of the cautionary FOMC minutes.

- Policymakers saw intensified risks around trade policy and said gradual hikes were needed amid very strong economy though.

- On the data front, "US non-manufacturing ISM was firmer than expected with the composite index rising to 59.1 (58.2 expected) and non-factory business activity reaching 63.9, the highest since 2005.

- Further, private sector employment increased by 177,000 jobs from May to June according to the data released by the ADP Research Institute on Thursday.

- NFP is looming ahead, plus US-China war tensions are likely to keep markets risk averse weighing on the pair.

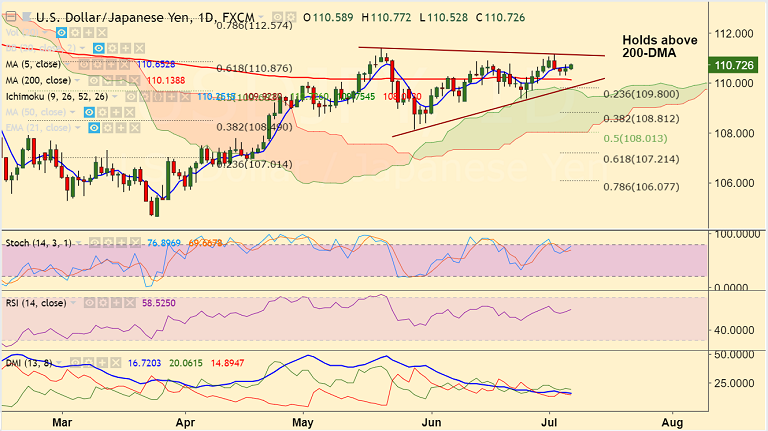

- USD/JPY is trading 0.13% higher on the day at 110.73 at the time of writing. Price action holds above daily cloud and 200-DMA support.

- Momentum still with the bulls. Technicals do not show any clear signs of reversal. We prefer to wait for clear directional bias.

Support levels - 110.65 (5-DMA), 110.30 (21-EMA), 110.13 (200-DMA)

Resistance levels - 111, 111.15 (trendline), 111.40 (May 21 high)

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -75.0113 (Neutral), at 0445 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.