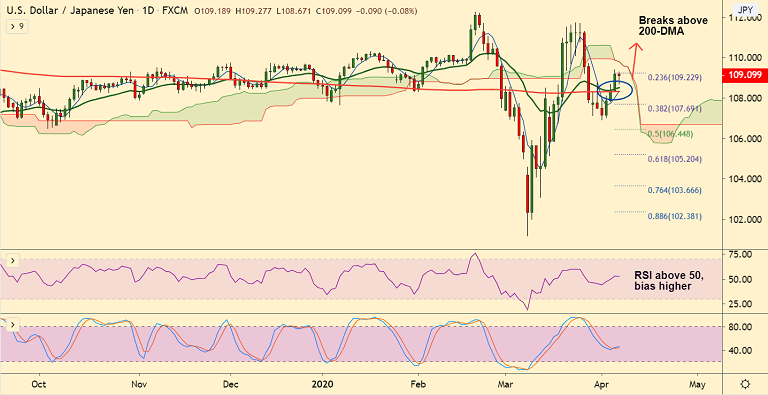

USD/JPY chart - Trading View

USD/JPY has bounced off session lows at 108.67 and was trading at 109.10 at 10:40 GMT.

The pair's near-term outlook has turned bullish after breakout at 200+DMA resistance on Monday's trade.

On the economic front, Japan's preliminary estimate of the February Leading Economic Index, came in at 92.1, beating the market’s forecast.

The Coincident Index for the February month was also better than anticipated, rising to 95.8.

Improving COVID-19 situation in some of the worst-hit countries dampens demand for the safe-haven yen.

Major trend in the pair is neutral, but minor trend is showing signs of bullishness as evidenced by the GMMA indicator.

Next major resistance aligns at 109.79 (daily cloud), break above to see retest of March highs at 111.71.

21-EMA is immediate support at 108.50. Retrace below 200-DMA negates any bullish bias.

Major Support Levels: 108.50 (21-EMA), 108.33 (converged 5 and 200 DMA), 107.69 (38.2% Fib)

Major Resistance Levels: 109.22 (23.6% Fib), 109.79 (Daily cloud), 110.29 (Jan 17 high)

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch