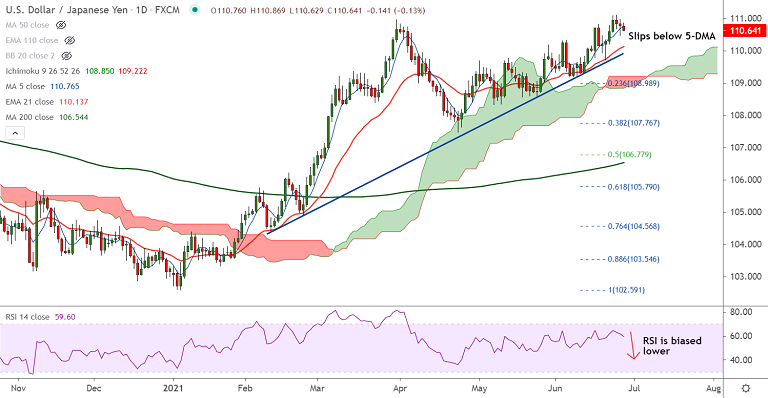

USD/JPY chart - Trading View

- USD/JPY was trading 0.13% lower on the day at 110.64 at around 04:10 GMT, bias bearish.

- The pair is extending weakness for the 3rd straight session, slips below 5-DMA support.

- Downside could be limited as the major technical trend remains bullish and the greenback could benefit from the US Core Personal Consumption Expenditures (PCE) Price Index last week.

- The Fed’s preferred gauge of Inflation, jumped to the highest in the near three decades with 3.4% YoY figures in May.

- US dollar index (DXY) picks up bids near 91.85, up 0.05%, after bouncing off 200-DMA support with a Dragonfly Doji formation on Friday's trade.

- Renewed fears of inflation and the coronavirus (COVID-19) favor the US dollar’s demand, due to its risk-safety allure.

- Adding to the USD support was Minneapolis Federal Reserve President Neel Kashkari's comments, “Expecting to see some of the very high inflation readings to return back down to normal."

- Focus on Fedspeak in the US session. Should the Fed policymakers raise doubts over their “transitory” outlook for inflation fears, USD could garner further traction.

Major Support Levels:

S1: 110.50 (200H MA)

S2: 110.13 (21-EMA)

S3: 109.43 (55-EMA)

Major Resistance Levels:

R1: 110.70 (Trendline resistance)

R2: 111.11 (Monthly high)

R3: 111.39 (76.4% Fib)

Summary: USD/JPY extends weakness for the 3rd straight session. The pair opens the the week's trade with marginal losses, but major trend remains bullish. Overbought conditions may cause some weakness, but pullbacks are likely to be limited.

200H MA is immediate support at 110.50, major weakness only below 21-EMA (110.13). Price action is pivotal at major trendline resistance at 110.70. Decisive break above will fuel further gains.