- USD/JPY is slightly bid on the day as the pair benefits from risk reversal early on in the Asian session.

- The pair has edged higher from fresh 4-month lows at 110.73 hit on Wednesday's trade.

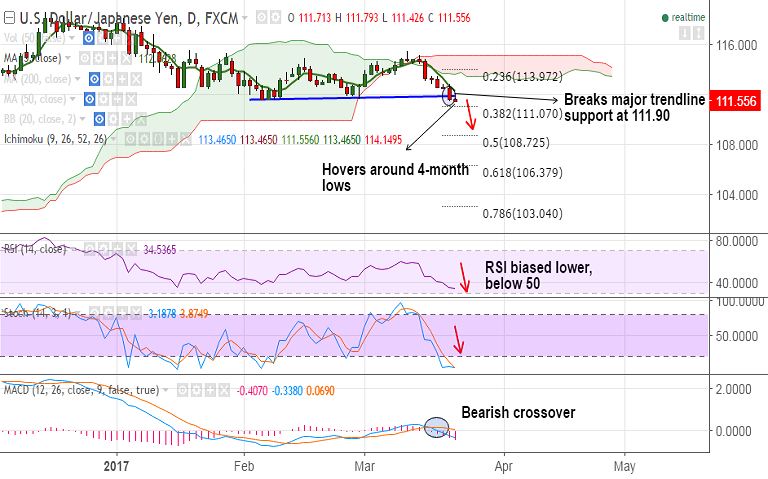

- Downside seems to have paused at 38.2% Fib retracement of 98.78 to 118.662 rally.

- Weekly cloud at 111.27 is another strong support for the pair.

- Close below weekly cloud top at 111.27 could see an extension of weakness next week.

Support levels - 111.27 (Weekly cloud top), 111.07 (38.2% Fib), 110.73 (March 22 low)

Resistance levels - 111.88 (5-DMA), 112, 112.86 (March 21 high)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-USD-JPY-breaks-below-100-DMA-good-to-go-short-on-rallies-597637) has achieved all targets.

Recommendation: Book full profits. Watch out for a close below weekly cloud top at 111.27 for further bearish bias.

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -103.784(Bearish), while Hourly JPY Spot Index was at 153.175 (Bullish) at 0520 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.