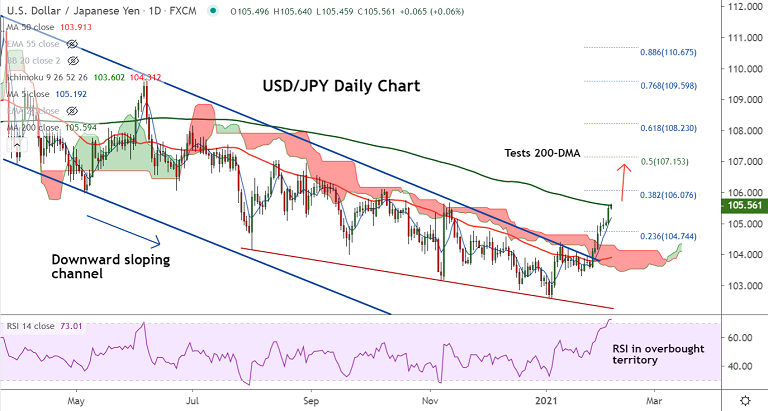

USD/JPY chart - Trading View

USD/JPY consolidates previous session's spike, hovers around 200-DMA. Price has tested 3-month high before paring some gains.

The pair was trading 0.07% higher at 105.57 at around 04:40 GMT, slightly lower from session highs at 105.64.

Technical outlook for the pair remains bullish, but overbought oscillators mat cause some minor pullbacks.

On the data front, the crucial US Nonfarm Payrolls (NFP) and Unemployment Rate for January will be watched for impetus.

Data overnight showed a larger-than-expected decline in U.S. jobless claims, supporting expectations of a positive surprise on Friday's NFP.

200-DMA is major resistance at 105.60. Decisive break above will fuel further gains in the pair.

Next major bull target lies at 55W EMA at 105.89 ahead of 38.2% Fib at 106.07. Failure to break above 200-DMA could cause weakness on account of overbought oscillators.