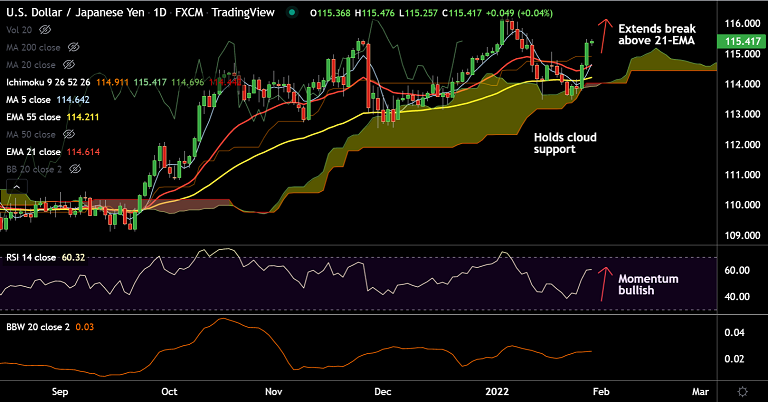

Chart - Courtesy Trading View

USD/JPY is on track to close the week with massive gains. The pair was trading 1.55% higher on the week till date.

The major was trading rangebound on the day as bulls consolidate previous session's 0.64% gains.

The Federal Reserve confirmed a rate hike coming in March, fueling speculation of at least four hikes this year.

The greenback got additional support from upbeat data overnight, with Q4 GDP at 6.9%, beating expectations at 5.5%.

Meanwhile, unemployment claims in the week ended January 14 met expectations by printing at 260K.

Major Support Levels:

S1: 114.83 (20-DMA)

S2: 114.61 (21-EMA)

S3: 114.21 (55-EMA)

Major Resistance Levels:

R1: 116

R2: 116.18 (Upper M BB)

R3: 116.66 (88.6% Fib)

Summary: The major has snapped a two week downside and has resumed bullish bias. Price action has broken above 20-DMA and is on track to test 116 levels.