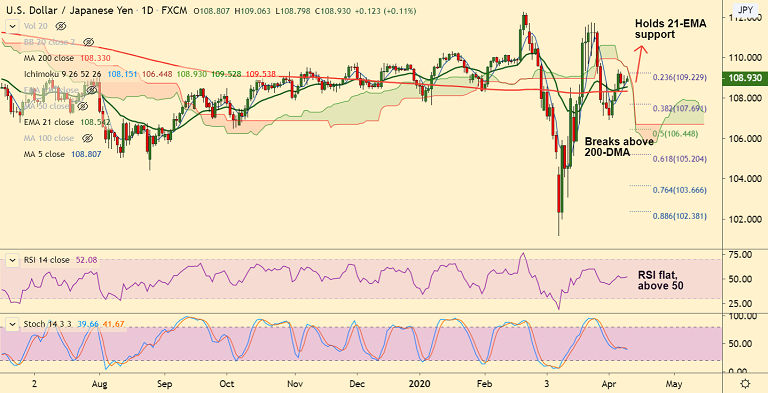

USD/JPY chart - Trading View

USD/JPY was trading marginally higher on the day at 108.94 at around 06:45 GMT.

The pair has held support at 21-EMA on Wednesday's trade, weakness only on break below.

FOMC minutes overnight highlighted concerns over the swiftness with which the coronavirus outbreak was harming the U.S. economy and disrupting financial markets.

The Fed reiterated that it would be appropriate to maintain rates at the current near-zero levels.

Fed Powell's speech and US jobs data will be watched for impetus ahead of the long weekend.

GMMA indicator shows major trend in the pair is neutral and minor trend is turning slightly bullish.

Daily cloud is stiff resistance. Break above could buoy prices. On the flipside, failure to hold above 200-DMA will negate any upside bias.

Major Support Levels - 108.54 (21-EMA), 108.33 (200-DMA), 107.69 (38.2% Fib)

Major Resistance Levels - 109.22 (23.6% Fib), 109.53 (Daily cloud), 109.66 (200W MA)

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis