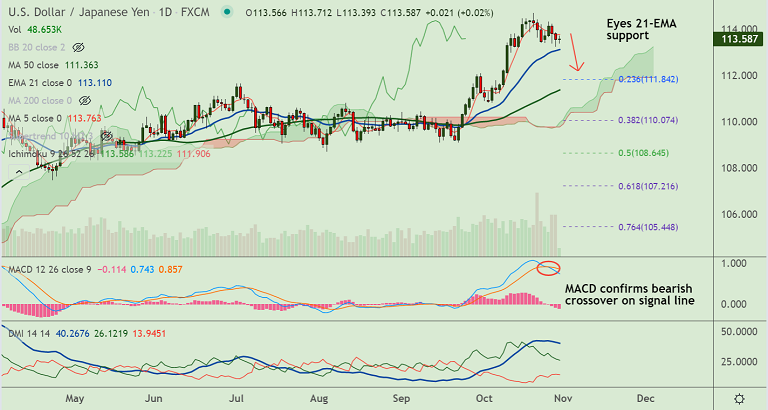

USD/JPY chart - Trading View

USD/JPY was trading largely muted on the day at 113.60 at around 05:50 GMT, with session high at 113.71 and low at 113.39.

The pair is consolidating previous session's weakness and remains rangebound below 5-DMA.

Dismal US GDP data which showed the slowest pace in more than a year kept the greenback under pressure.

Data released overnight showed gross domestic product grew at only a 2% annualized rate in the quarter ended in September, missing forecasts at a 2.7% rate.

Further, consumers' inflation expectations over the next 12 months jumped to a 13-year high.

The dollar index (DXY) was headed for a third straight weekly decline, while benchmark 10-year U.S. Treasury yields were set for their biggest weekly decline in three months.

Market participants now await the Fed policy meeting next week. Investors focus on how the Federal Reserve responds to higher inflation and concerns over tepid economic growth.

Major Support Levels:

S1: 113.24 (20-DMA)

S2: 113.11 (21-EMA)

S3: 113

Major Resistance Levels:

R1: 113.77 (5-DMA)

R2: 113.93 (200H MA)

R3: 114

Summary: USD/JPY was trading with a bearish technical bias. 21-EMA offers strong support at 113.11. Break below will see more downside. Retrace above 200H MA to see upside resumption.