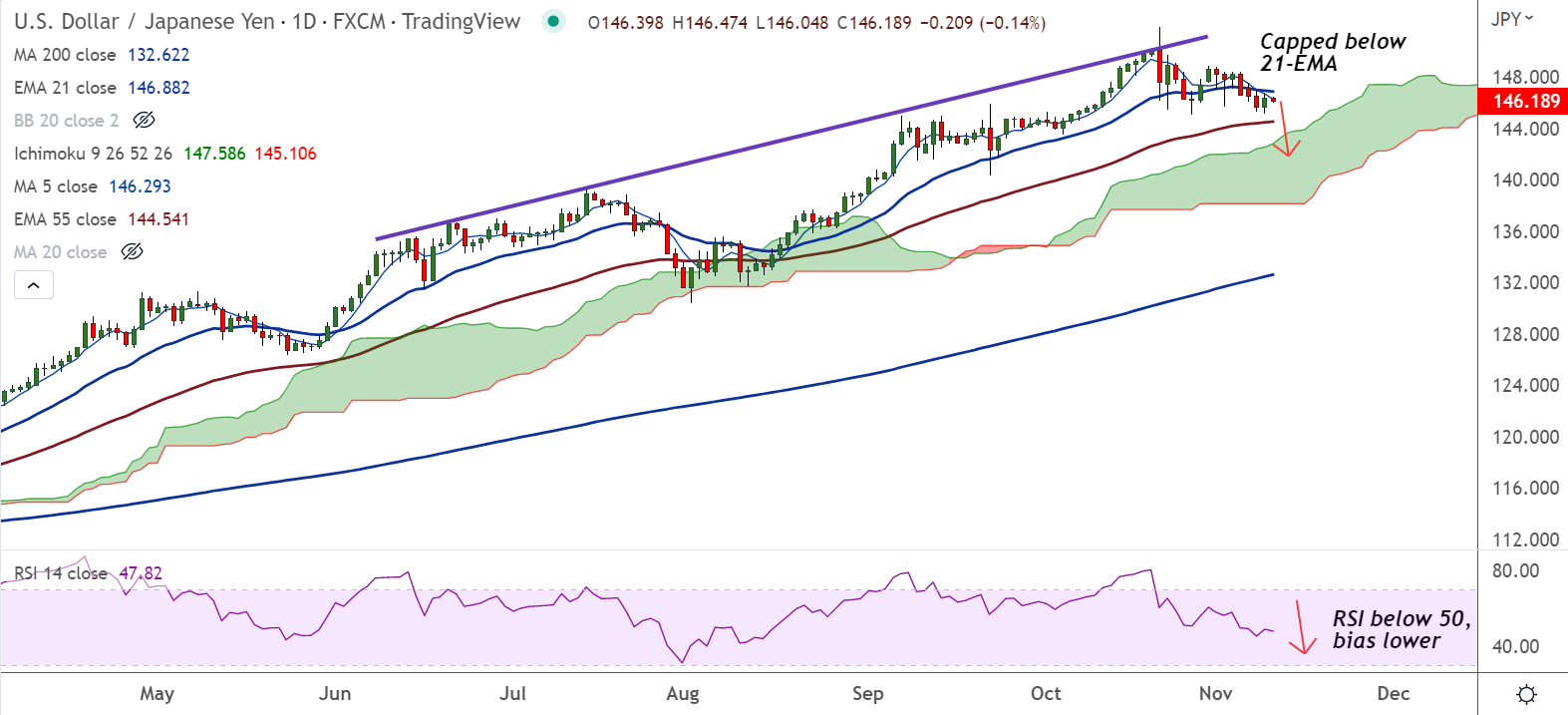

Chart - Courtesy Trading View

USD/JPY was trading 0.17% lower on the day at 146.15 at around 04:30 GMT.

The pair's recovery attempts on the previous day were capped at 21-EMA, US inflation data will be crucial to determine further direction.

Bank of Japan (BOJ) Governor Haruhiko Kuroda reiterated the Japanese central bank’s easy money policy.

Kuroda also turned down the hopes of any direct forex market intervention by the central bank to safeguard the yen.

Sluggish yields and the latest comments from Kuroda exert downside pressure on the Yen pair.

Cautious optimism prevails ahead of crucial US inflation data, downbeat forecasts tease bears.

Major Support Levels:

S1: 145.22 (Lower BB)

S2: 144.54 (110-EMA)

Major Resistance Levels:

R1: 146.88 (21-EMA)

R2: 147.80 (20-DMA)

Summary: USD/JPY capped below 21-EMA. Technical bias is bearish. Retrace above 21-EMA will negate any bearish bias.