The USD/JPY declined on Wednesday as demand for safe heaven Japanese yen increased on concerns over US economic growth.

- The pair edged higher in the European session, to hit high at 114.55 before slipping back sharply in the American session.

- Further downside is expected to be limited as the pair finds strong support at 112.80 which should limit downside and bring a rebound back towards higher levels.

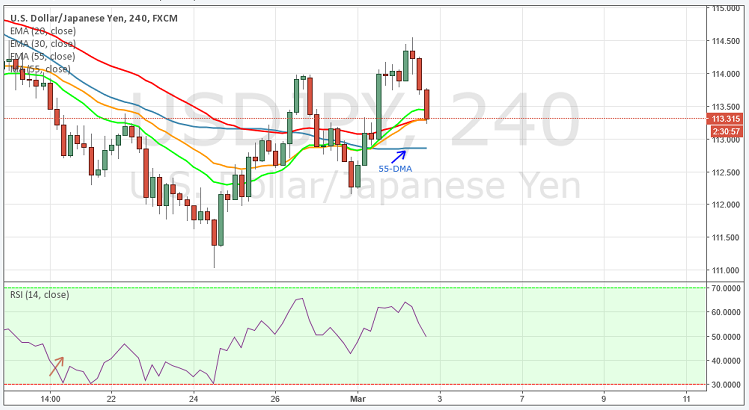

- Technically, the pair is trading above its 55 DMA. The RSI in the 4 hour chart is indicating slightly down side at 49, meanwhile the 55, 30 and 20 MA's are flat.

- To the upside, the strong resistance can be seen at 114.00, a break above this level would take the pair towards next resistance level at 114.74.

- To the downside immediate support can be seen at 112.80, a break below this level will open the door towards next level at 112.10.

Recommendation: Go long around 112.80, targets 113.60, 114.00, SL 112.00.

Resistance Levels

R1: 114.00 (38.2% Retracement Level)

R2: 114.17 (March 1st high)

R3: 114.74 (23.6% Retracement Level)

Support Levels

S1: 113.30 (Session lows)

S2: 112.80 (61.8% Retracement Level)

S3: 112.10 (March 1st lows)