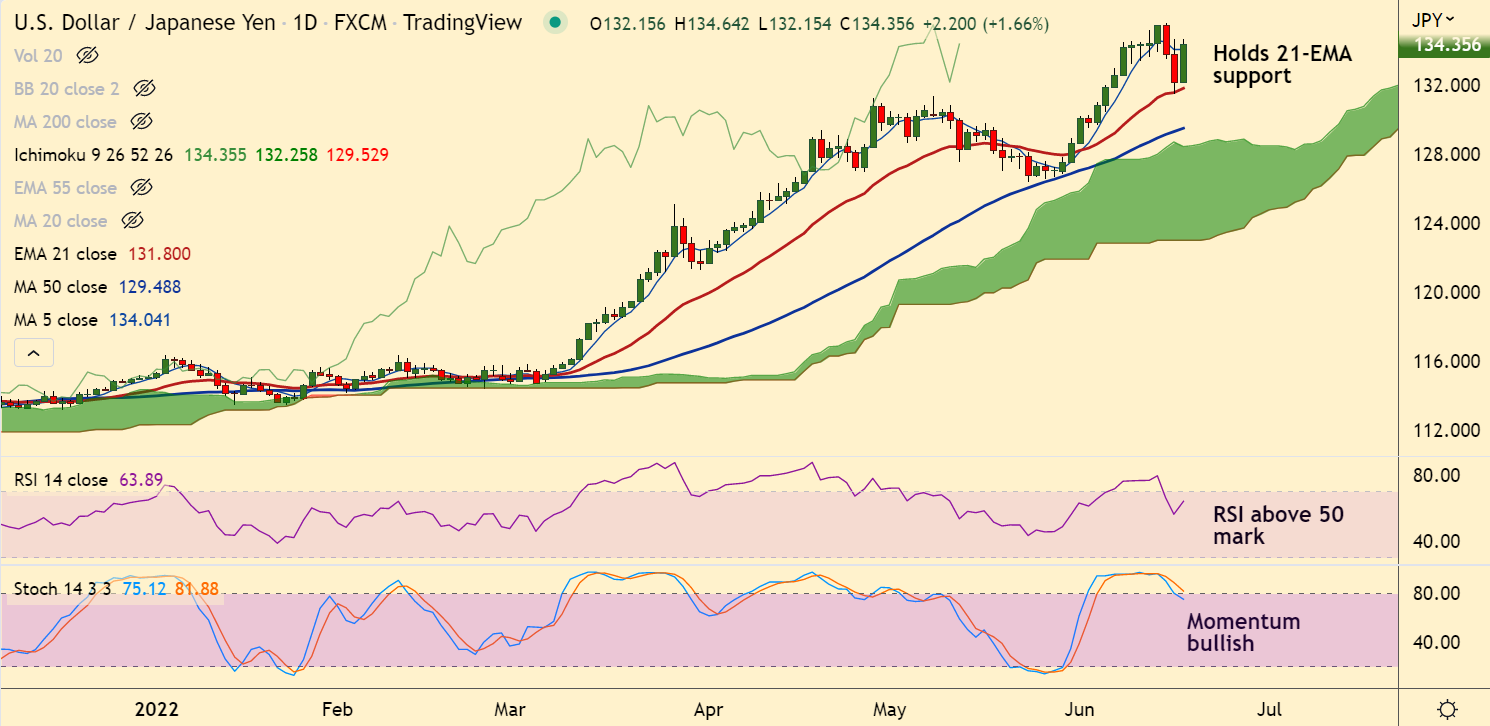

Chart - Courtesy Trading View

USD/JPY was trading 1.47% higher on the day at 134.09 at around 06:30 GMT, slightly lower from session highs at 134.64.

The pair snapped two day downside and spiked higher in a knee-jerk reaction after BoJ policy decision.

The Bank of Japan kept monetary policy unchanged but mentioned readiness to watch FX reaction for the first time.

BOJ kept its benchmark rate near -0.10% while also holding the 0.0% target for the Japanese Government Bond (JGBs) at the end of two-day monetary policy meeting.

The mention of the FX in the BOJ statement dampened the Japanese yen across the board.

Focus now on the US Industrial Production for May, expected at 0.4% versus 1.1% prior, ahead of the Fed’s Monetary Policy Report and Powell’s speech.

Technical bias for the pair is bullish. Retrace has found strong support at 21-EMA, weakness only on break below.