• USD/JPY eased slightly on Monday despite stronger US dollar as investors turn their attention towards U.S. inflation data and comments by Federal Reserve officials this week.

• A slew of Fed officials are due to speak at events this week, which could give further clues on the direction of the central bank's future interest rate trajectory. Focus will also be on U.S. September inflation figures on Thursday.

•The release of minutes from the Fed's September meeting on Wednesday is expected to explain its big rate cut last month.

• At GMT 04:06, the pair was trading down 0.74% at 141.35, lowest since January 2nd .

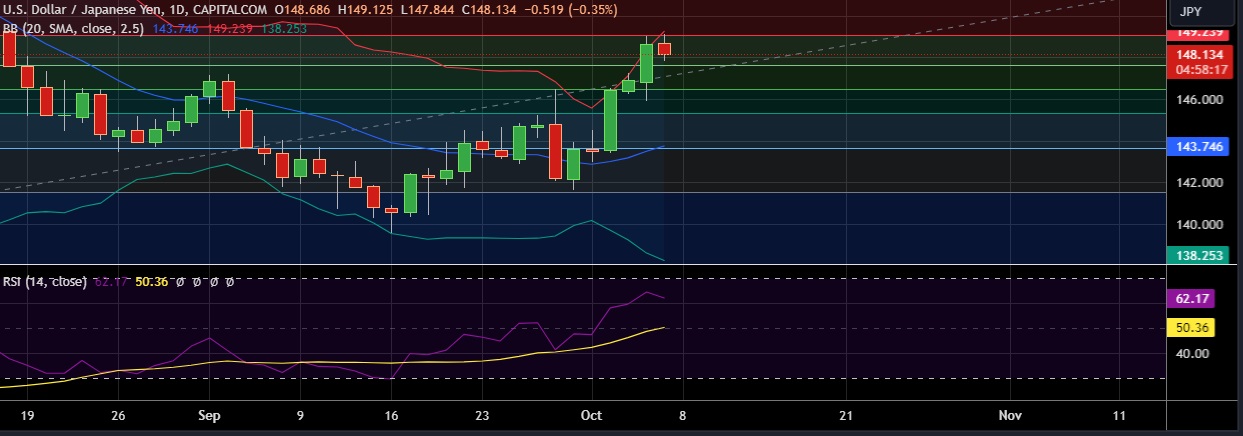

• Technical signals are strongly bullish as RSI is at 62, daily momentum studies 5, 9 and 10 DMAs are trending up.

• Immediate resistance is located at 149.07(23.6%fib), any close above will push the pair towards 149.26 (Higher BB).

• Support is seen at 147.80 (38.2%fib) and break below could take the pair towards 146.68 (50%fib)

Recommendation: Good to buy around 148.00, with stop loss of 147.50 and target price of 149.00