USD/JPY chart - Trading View

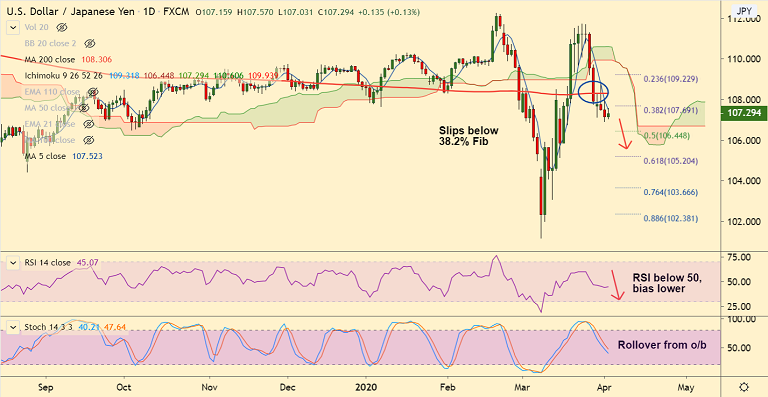

USD/JPY has slipped below 38.2% Fib, bias is strongly bearish.

The major was trading 0.12% higher on the day at 107.27 at around 09:30 GMT, after closing 0.31% lower in the previous session.

The ADP Non-Farm Payrolls and the ISM Manufacturing Purchasing Managers’ Index released on Wednesday beat expectations, but failed to benefit the US dollar.

Focus now on jobless claims report for the week ended March 21st. Goldman Sachs foresees 5.25 million claims.

Technical indicators are turning bearish. Stochs and RSI are now biased lower. MACD shows bearish crossover on signal line.

Upside was capped at 5-DMA at 107.52. Bearish 5-DMA crossover on 20-DMA adds to the bearish bias.

Immediate support lies at 106.44 (Kijun sen and 50% Fib). Further bearish momentum could see test of 61.8% Fib at 105.20.

Support levels - 107, 106.44 (Kijun sen and 50% Fib), 106, 105.20 (61.8% Fib)

Resistance levels - 107.52 (5-DMA), 108.30 (200-DMA), 108.75 (50-DMA)

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data