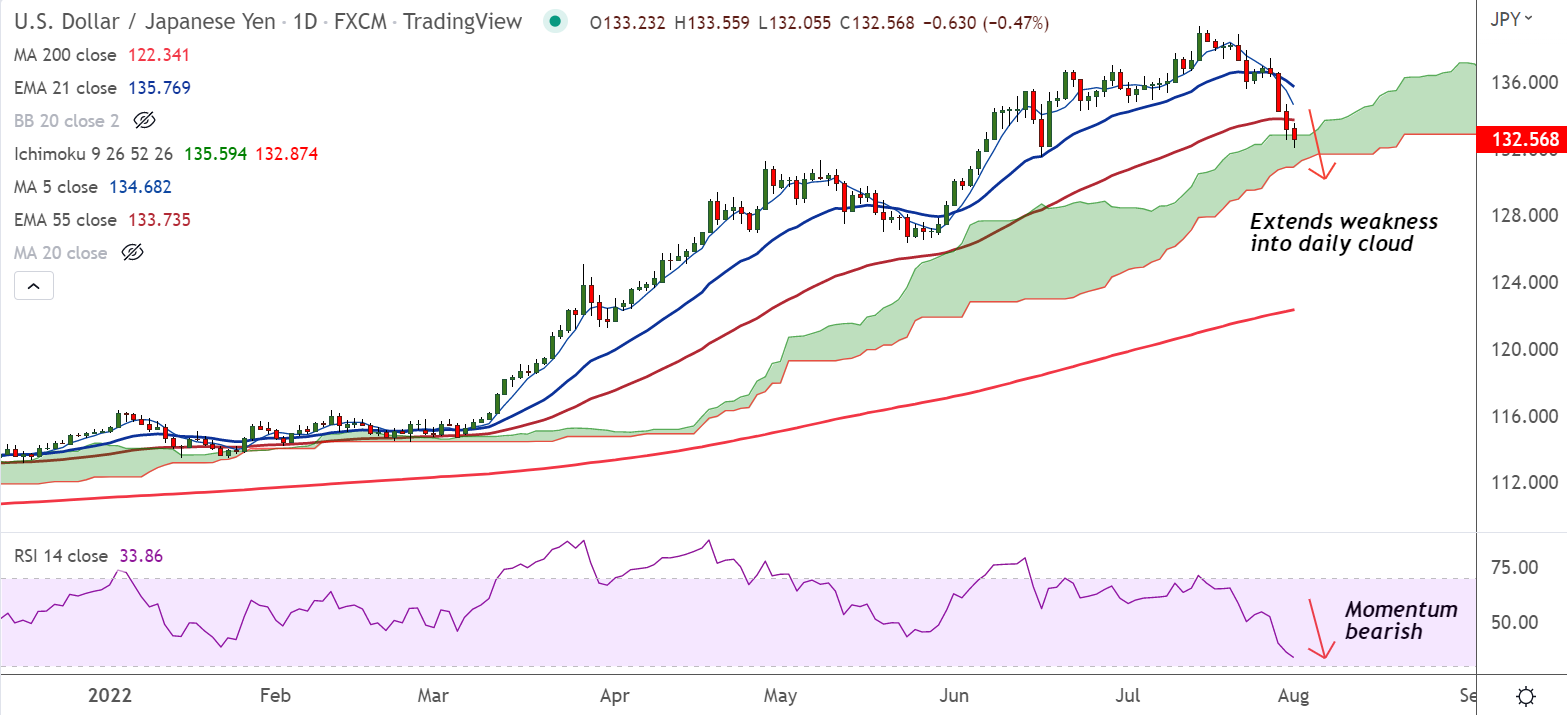

Chart - Courtesy Trading View

USD/JPY was trading 0.56% lower on the day at 132.46 at around 04:40 GMT. The pair is extending weakness for the fourth straight session, slips into the daily cloud, raising scope for further downside.

The US dollar hammered as markets continued to wager that the Federal Reserve has less tightening to do with the U.S. economy at risk of recession. Markets are now pricing in only 31% probability that the Fed will raise rates by 75 basis-point at its next meeting on Sept. 21. While 69% odds stay in favour of a 50 basis point increase.

Data last Friday showed the Fed's closely watched University of Michigan consumer inflation expectations slipped lower, weighing on the dollar. Major focus for this week will be the monthly U.S. jobs report due on Friday. Later in the day, attention turns towards the US ISM PMI data for direction.

Technical Analysis:

- USD/JPY breaks into the daily cloud

- Momentum is strongly bearish, stochs and RSI are sharply lower

- Volatility is high and rising, RSI divergence adds to the downside bias

- Price action is below 200H MA and GMMA indicator turns bearish on the intraday charts

Major Support Levels: 130.89 (Cloud base), 129.57 (110-EMA)

Major Resistance Levels: 133.73 (55-EMA), 134.68 (5-DMA)

Summary: USD/JPY trades with a bearish bias. The pair is poised for further downside. Next major support lies at 110-EMA at 129.57.