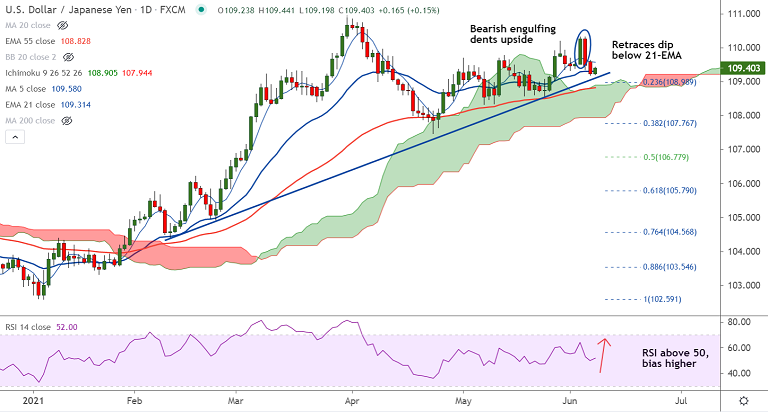

USD/JPY chart - Trading View

USD/JPY was trading 0.15% higher on the day at 109.40 at around 04:40 GMT, snapping 2-days of downside.

US 10-year Treasury yields fail to extend the previous day’s corrective pullback around 1.56% whereas the US dollar index (DXY) snaps two-day declines and was trading 0.10% higher at 90.06.

The latest US jobs reports dragged inflation expectations to a six-week low, added extra strength in rejecting the reflation fears and also the Fed’s tapering woes.

Market sentiment improved, putting a bid under the US dollar ahead of the crucial inflation data on Thursday.

Biden’s infrastructure spending plan and removing of the covid-led activity restrictions in Canada and the UK keep markets risk positive.

Major trend in the pair is bullish. Price action is above cloud and major moving averages. Weakness only below 55-EMA.

Focus now on US Good and Services Trade Balance for April ahead of Thursday’s US Consumer Price Index (CPI) data.