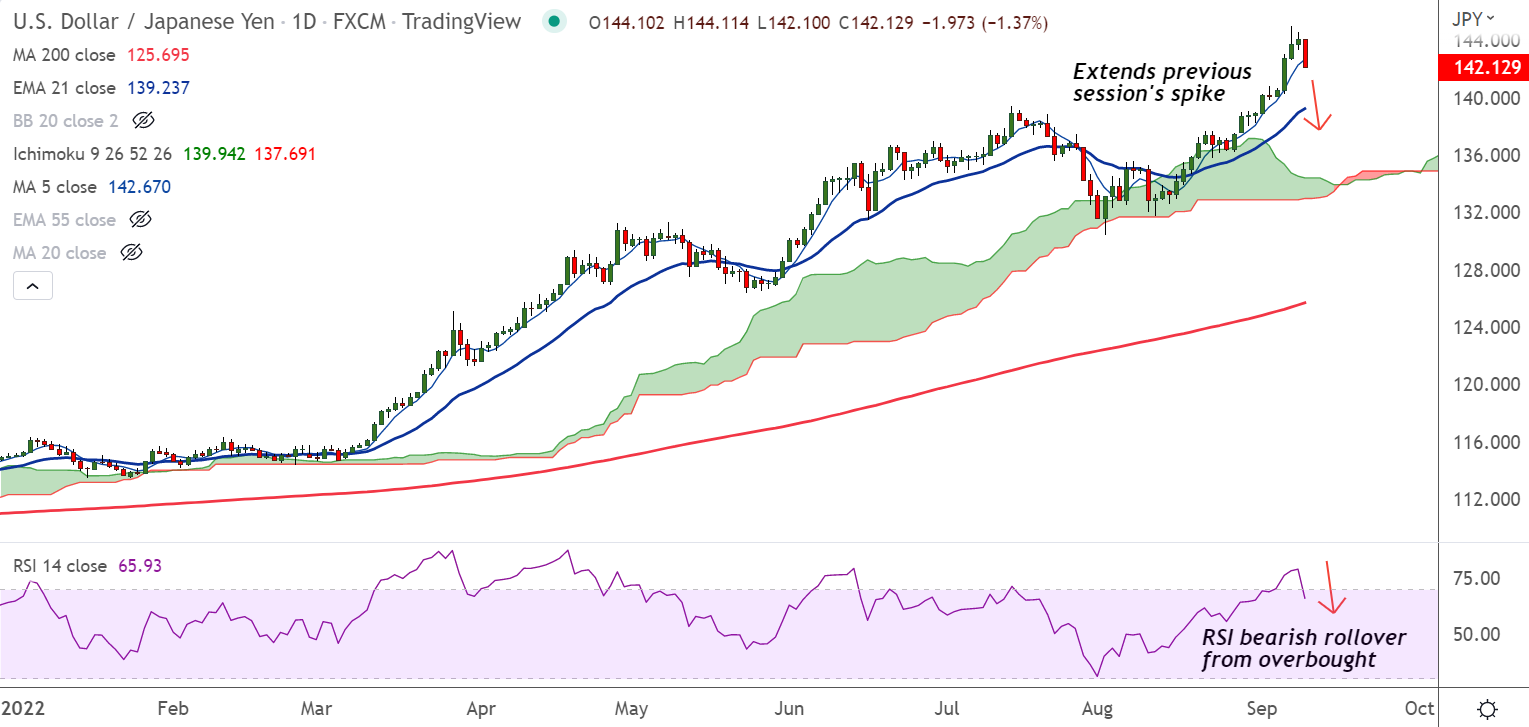

Chart - Courtesy Trading View

Spot Analysis:

USD/JPY was trading 1.27% lower on the day at 142.33 at around 07:50 GMT

Previous Week's High/ Low: 140.80/ 137.55

Previous Session's High/ Low: 144.55/ 143.31

Fundamental Overview:

Speculations that the Bank of Japan (BoJ) may soon step in to arrest the freefall in the Japanese yen adds downside pressure.

That said, Fed-BoJ policy divergence is likely to act as a tailwind for the major and limit deeper losses.

On the data front, US Weekly Initial Jobless Claims slumped to the lowest levels since May, with the latest figures beyond 222K.

With no major market-moving economic data due for release from the US, focus will be on Fed speak for impetus.

Technical Analysis:

- USD/JPY slips below 5-DMA, eyes 200H MA on the intraday charts

- GMMA indicator shows minor trend is bearish, while major trend is turning bearish on the intraday charts

- Stochs and RSI are at overbought levels, scope for bearish rollover

- ADX and MACD support upside in the pair, but Chikou span is biased lower

Major Support and Resistance Levels:

Support - 141.05 (200H MA), Resistance - 142.71 (5-DMA)

Summary: USD/JPY is seeing some long unwinding. Major trend remains bullish and pullbacks are likely to be shallow. Major weakness only below 21-EMA.