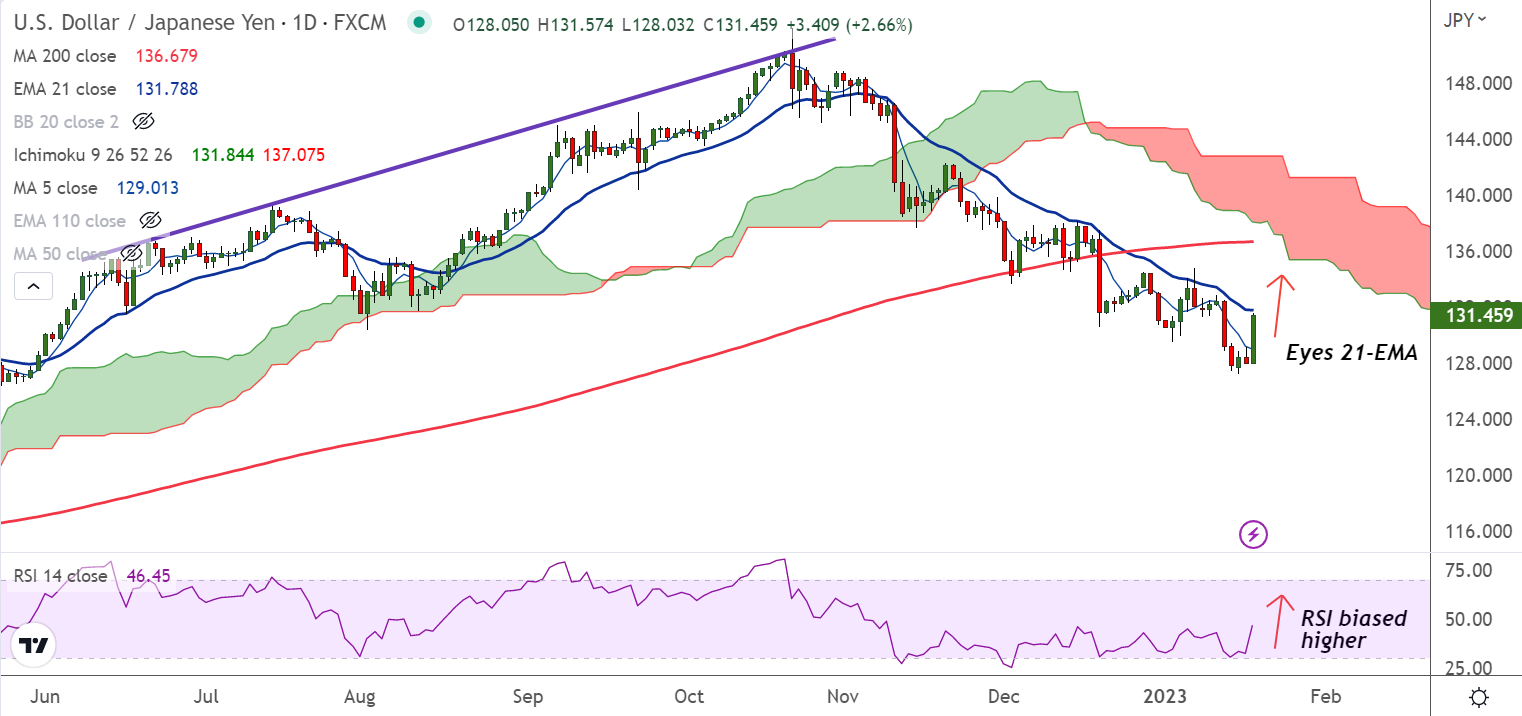

Chart - Courtesy Trading View

USD/JPY spiked over 2.5% to break past 131 barrier and was trading at 131.33 at around 05:00 GMT.

The Japanese yen was dumped across the board after the Bank of Japan (BoJ) unanimously decided to keep its yield curve controls in place.

The central bank maintained its short-term policy interest rate at negative 0.1%, and kept its long-term interest rate at 0%.

BoJ maintained ultra-low interest rates, including its 0.5% cap for the 10-year bond yield, defying market expectations it would phase out its massive stimulus programme.

The 10-year yield which had edged above the policy cap of 0.5% to an intraday high of 0.5100%, retreated sharply to 0.360% on Wednesday.

Japan Nationwide consumer price index inflation data for December is due this Friday, and is widely expected to show prices at over 40-year highs. Inflation is expected to rise to 4%- twice the BOJ’s 2% annual target.

Major Support Levels:

S1: 130.68 (200H MA)

S2: 129.01 (5-DMA)

Major Resistance Levels:

R1: 131.78 (21-EMA)

R2: 132.87 (Previous week's high)

Summary: USD/JPY technical bias has turned bullish on the intraday charts. Price action has edged above 200H MA. Major trend however, remains bearish. Decisive break above 21-EMA could change near-term dynamics.