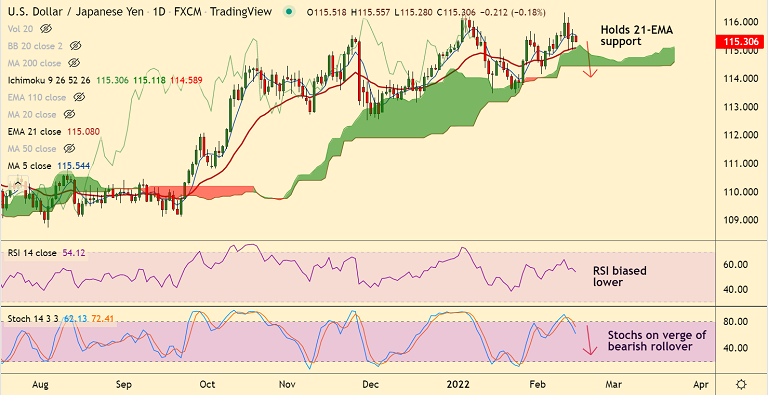

Chart - Courtesy Trading View

Spot Analysis:

USD/JPY was trading 0.14% lower on the day at 115.36 at around 05:05 GMT

Previous Week's High/ Low: 116.33/ 114.91

Previous Session's High/ Low: 115.74/ 115.01

Fundamental Overview:

Geopolitical risk will be the clear driver of sentiment for markets this week. The United States warned on Monday that Russia could soon invade Ukraine.

Sentiment sour as investors contemplated the implications of a potential imminent Russian invasion of Ukraine.

The Federal Open Market Committee (FOMC) minutes of the meeting held earlier this month will be released on Thursday, with a detailed record over inflation concerns.

The minutes will provide insights regarding the FOMC's stance on monetary policy and will be carefully watched for clues regarding future interest rate decisions.

Technical Analysis:

- USD/JPY fails to extend previous session's gains

- Upside remains capped at 5-DMA

- Price action has formed a Doji on the weekly candle till date

- Major trend remains bullish according to the GMMA indicator

- Strong support seen at 21-EMA, major weakness only on break below

Major Support and Resistance Levels:

Support - 115.07 (21-EMA), Resistance - 115.54 (5-DMA)

Summary: USD/JPY likely to extend sideways at 21-EMA support, major weakness only on break below. Scope for upside resumption. Focus on FOMC minutes for cues.