USD/JPY edged slightly higher on the back of the mixed Japanese, but traders may be reluctant to create large positions into the closing day in liquidity thinned markets

- Today's data calls for more easing from BoJ. Japan's core consumer prices fell in October for the third straight month. Household spending slumped as well

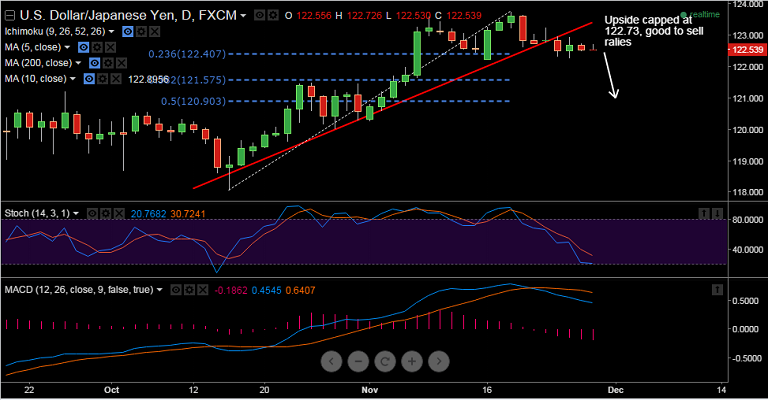

- The pair was rejected at highs, upside seems to be capped at 122.73 (Nov 26 high), breaks above would see the pair at major resistance at 122.90

- No major chart support seen on the downside, minor support lies at 122.50 (Nov 26 lows) and further below at 122.40 (23.6 % Fibo of 118.05-123.75 rise). Breaks below could take the pair to 121.63 levels

Trade Idea: Sell rallies around 122.60, SL: 123, TP: 121.80

Resistance Levels:

R1: 122.63 (5 DMA)

R2: 122.90 (10 DMA)

R3: 123 (Psychological Level)

Support Levels:

S1: 122.40 (23.6 % Fibo of 118.05-123.75 rise)

S2: 122.22 (Nov 16 low)

S3: 121.80 (Aug 21 lows)