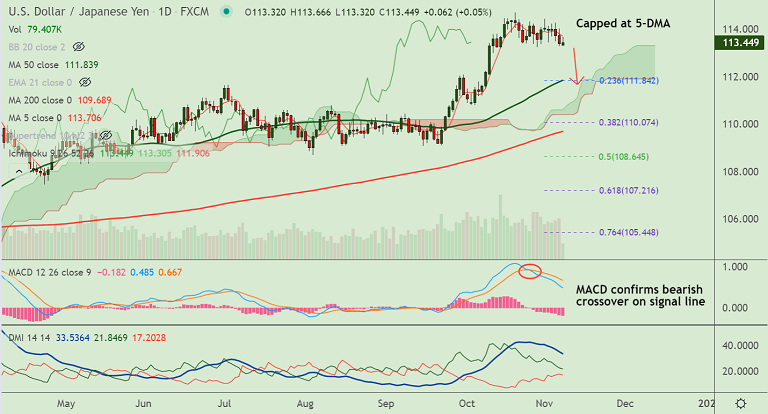

USD/JPY chart - Trading View

Spot Analysis:

USD/JPY was trading 0.04% higher on the day at 113.43 at around 10:05 GMT.

Session High/ Low: 113.66/ 113.32

Previous Week's High/ Low: 114.44/ 113.29

Previous Session's High/ Low: 114.03/ 113.29

Fundamental Overview:

Greenback remains on the defensive after US central bank last week reiterated that the inflation is transitory.

Also, Fed Chair Jerome Powell said that policymakers were in no rush to hike borrowing costs.

Caution prevails in the markets ahead of inflation data from the United States and China this week.

Figures due Wednesday are expected to show U.S. consumer price at 5.8% year-on-year, supporting the Federal Reserve's intent to be patient with interest rate hikes.

Rebounding US bond yields should limit the USD losses and keep downside limited for the pair.

Technical Analysis:

- USD/JPY pivotal at 21-EMA support, breach below will drag prices lower

- Recovery attempts remain capped at 5-DMA

- MACD shows bearish bias, Chikou span is biased lower

- Stohcs and RSI show bearish bias, volatility is low

Major Support and Resistance Levels:

Support - 113.39 (21-EMA), Resistance - 113.70 (5-DMA)

Summary: USD/JPY is extending sideways grind, after testing multi-month highs at 114.69 in the previous month. Watch out for break below 21-EMA for more weakness.