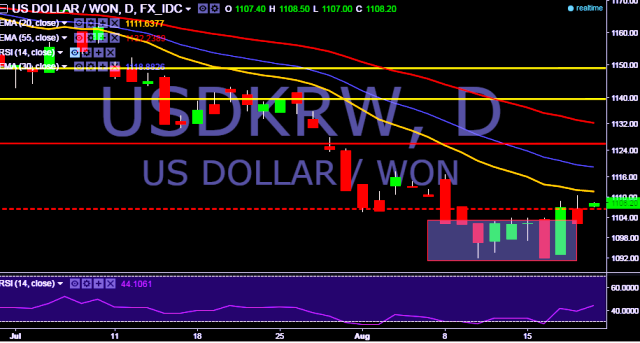

- USD/KRW is currently trading around 1,107 levels.

- It made intraday high at 1,108 and low at 1,107 levels.

- Intraday bias remains bullish till the time pair holds key support at 1,092 levels.

- A sustained close below 1,092 will test key supports at 1,078/1,063/1044 levels respectively.

- Alternatively, current up trend will drag the parity higher towards key resistances at 1,117, 1,124, 1,138, 1,142, 1,152, 1,162, 1,176, 1,182, 1,196, 1,201, 1,209 (20D EMA) and 1,220 (March 03, 2016 high) marks respectively.

- In addition, South Korea’s Kospi was trading around 0.03 percent lower at 2,054 points.

- South Korea’s July PPI growth Y/Y increase to -2.4 % vs previous -2.7 %.

- South Korea’ July PPI growth decrease to -0.1 % vs previous 0.2 %.

We prefer to take long position in USD/KRW only above 1,107 with stop loss at 1,092 and target of 1,142.