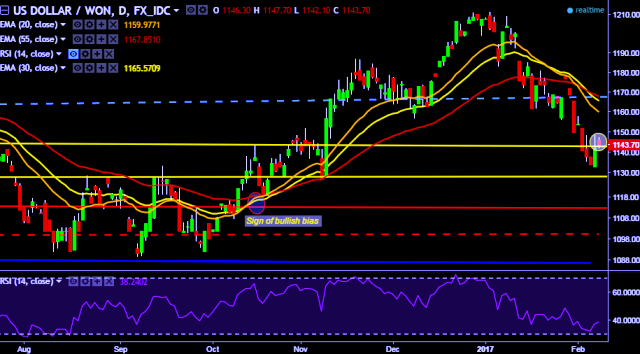

- USD/KRW is currently trading around 1,143 levels.

- Pair made intraday high at 1,147 and low at 1,142 marks.

- Intraday bias remains bearish till the time pair holds key resistance at 1,148 marks.

- A daily close above 1,142 will drag the parity higher towards key resistances at 1,148, 1,155, 1,168, 1,172, 1,186, 1,197, 1,203, 1,211 marks respectively.

- On the other side, a sustained close below 1,142 will test key supports at 1,133/1,124/1,117/1,107 levels respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- South Korea’s December L-money supply growth decreases to 7.5 % vs prev 8.0 %.

We prefer to take short position in USD/KRW only below 1,142, stop loss 1,153 and target of 1,132/1,127.