For those eyeing cheap optionality to protect returns against an abrupt Euro reversal, USDNOK risk reversals are worth keeping an eye on.

NOK has been helped by higher oil prices, but HUF, PLN, and even GBP have outperformed the euro. This has indeed been the trend in recent weeks judging from option returns in the above table, and we have exploited this phenomenon in recent weeks via RV constructs involving long USD/Europe vs short EUR cross long/short vol pair trades (the macro portfolio is running an EUR call/USD put – EUR call/NOK put switch along these lines).

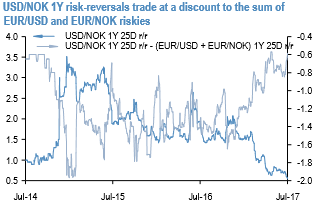

1Y 25D riskies (0.55 mid) are through their 2014 lows, nearly at par with EURUSD riskies, and priced 0.6 vols under the arithmetic sum of EURUSD and EURNOK riskies (refer above chart).

The latter is not the most extreme discrepancy in a historical context, but the combination of the skew discount with bargain-basement levels is rare and last seen before the onset of the dollar uptrend in 2014. The krone is fundamentally cheap, oil is in a mini-uptrend and the Euro bull move is intact, so patience is in order to finesse entry levels.

Owning USDNOK – EURUSD risk-reversal spreads as hedge overlays on bullish Euro positions is appealing in concept, however since returns from doing so have historically been anti-correlated to vol spikes without the kind of relentless interim bleed that vol longs are notorious for. Something to consider closer to the FOMC meeting in September perhaps.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics