- USD/SGD is currently trading around 1.3948 marks.

- It made intraday high at 1.3985 and low at 1.3939 levels.

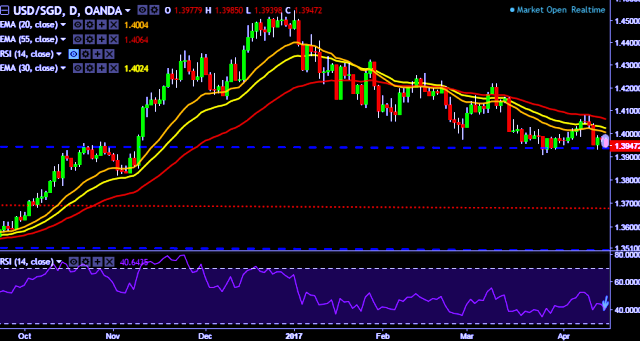

- Intraday bias remains bearish till the time pair holds key resistance at 1.3988 marks.

- A daily close above 1.3977 will test key resistances at 1.4027, 1.4077, 1.4160, 1.4219, 1.4266, 1.4327, 1.4409, 1.4506, 1.4568, 1.4686 and 1.4851 levels respectively.

- Alternatively, a consistent close below 1.3977 will drag the parity down towards key supports at 1.3930/1.3908/1.3851/1.3775/1.3704/1.3646 levels respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- Singapore’s March non-oil domestic exports -1.1 pct m/m after seasonal adjustment; poll -6.4 pct.

- Singapore’s March domestic exports of electronics +5.2 pct from year earlier.

- Singapore’s March non-oil domestic exports +16.5 pct from year earlier; poll +10.4 pct.

We prefer to take short position in USD/SGD only below 1.3930, stop loss 1.3988 and target of 1.3908/1.3851.