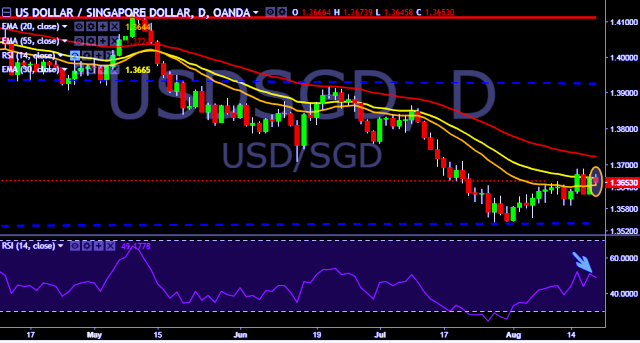

- USD/SGD is currently trading around 1.3650 marks.

- It made intraday high at 1.3673 and low at 1.3645 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 1.3689 mark.

- A daily close above 1.3689 will test key resistances at 1.3788, 1.3822, 1.3949, 1.4046, 1.4095, 1.4128, 1.4219 and 1.4310 levels respectively.

- Alternatively, a consistent close below 1.3618 will drag the parity down towards key supports at 1.3587/1.3545/1.3512/1.3435/1.3347 levels respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

We prefer to take short position in USD/SGD only below 1.3618, stop loss 1.3689 and target of 1.3545.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest