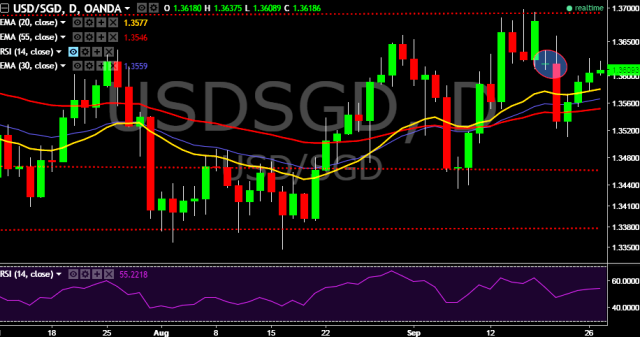

- USD/SGD is currently trading around 1.3605 marks.

- It made intraday high at 1.3622 and low at 1.36 levels.

- Intraday bias remains neutral till the time pair holds key support at 1.3578 marks.

- A daily close below 1.3578 will drag the parity down towards key supports at 1.3510/1.3462/1.3391/1.3347/1.3313/1.3302/ 1.3271 levels.

- Alternatively, a sustained close above 1.3638 will test key resistances at 1.3698, 1.3732, 1.3799, 1.3836, 1.3851(March 16, 2016 high), 1.4073 (20D EMA) and 1.4132(20D, 30D and 55D EMA crossover).

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

We prefer to go long on USD/SGD around 1.3600 with stop loss at 1.3578 and target of 1.3698.