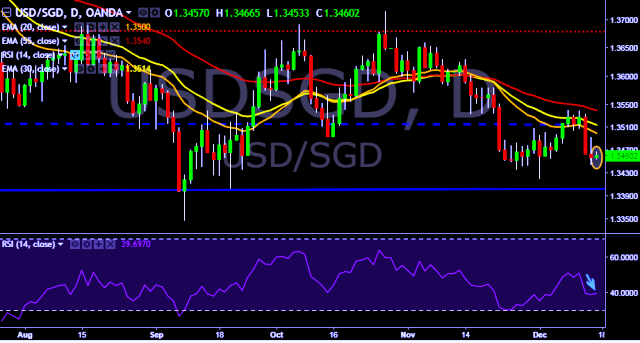

- USD/SGD is currently trading around 1.3460 marks.

- It made intraday high at 1.3466 and low at 1.3453 levels.

- Intraday bias remains neutral for the moment.

- A daily close above 1.3457 will test key resistances at 1.3532, 1.3580, 1.3602, 1.3652, 1.3715, 1.3768, 1.3822 and 1.3949 levels respectively

. - Alternatively, a consistent close below 1.3457 will drag the parity down towards key support at 1.3432/1.3396/1.3346/1.3217/1.3164/1.3005 levels respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

We prefer to take short position in USD/SGD only below 1.3443, stop loss 1.3492 and target of 1.3396.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest