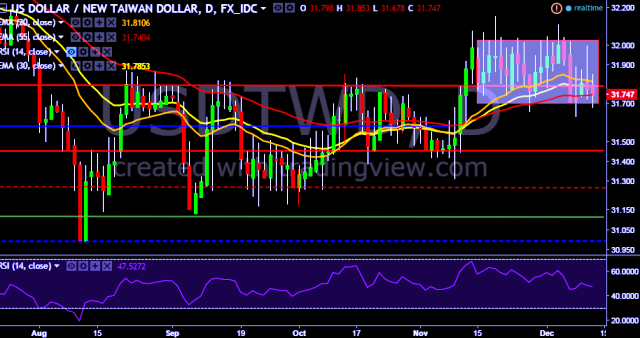

- USD/TWD is currently trading around 31.74 marks.

- It made intraday high at 31.85 and low at 31.67 marks.

- Intraday bias remains bearish for the moment.

- A daily close above 32.02 will drag the parity up towards key resistances around 32.20, 32.43 and 32.63 marks respectively.

- Key support levels are seen at 31.67, 31.56, 31.45, 31.38, 31.26, 31.18, 30.99, 30.85 and 30.39 marks respectively.

- Taiwan stocks open up 0.1 pct at 9,361.97 points.

We prefer to take short position in USD/TWD around 31.75, stop loss 32.00 and target of 31.50.