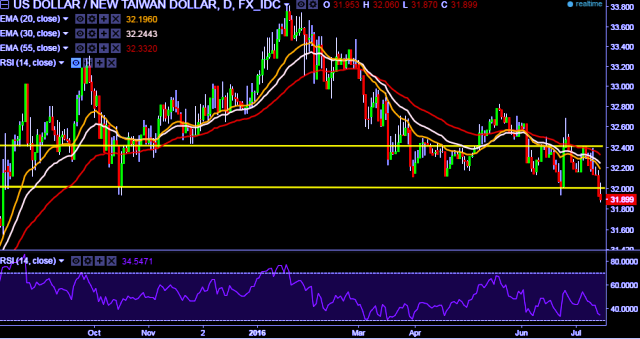

- USD/TWD is currently trading around 31.92 mark,

- It made intraday high at 32.06 and low at 31.87 marks.

- Intraday bias remains bearish till the time pair holds key resistance at 32.17 marks.

- A sustain close below 32.00 mark will tests key supports at 31.72, 31.58, 31.40 and 31.17 marks respectively.

- Alternatively, reversal from key support will drag the parity higher back above 32.00 marks to test key resistances at 32.17, 32.25, 32.43 and 32.63 marks respectively.

- In addition, Taiwan stocks open down 0.1 pct at 8,857.15 points. It was trading around 0.70% higher at 8,928.51 points.

We prefer to take short position in USD/TWD only below 31.87, stop loss 32.17 and target 31.58/ 31.40 marks.