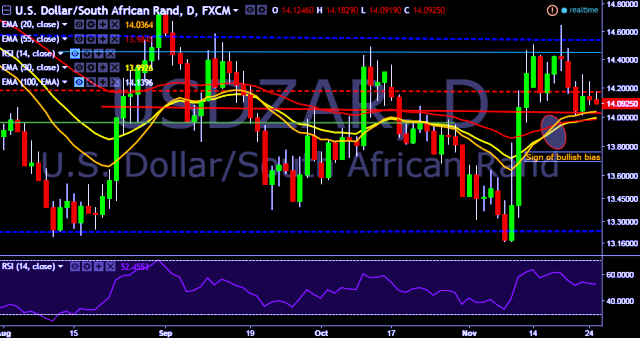

- USD/ZAR is currently trading around 14.09 levels.

- It made intraday high at 14.18 and low at 14.09 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 14.20 marks.

- A daily close above 14.20 will take the parity higher towards key resistances around 14.50, 14.75, 14.96, 15.05, 15.28, 15.45, 15.66, 15.77, 15.86(February 29, 2016 high) and 16.15 marks respectively.

- Alternatively, a daily close below 14.01 will drag the parity down towards key supports at 13.70, 13.57, 13.31, 13.19, 13.01, 12.82 and 12.58 levels respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

We prefer to go short on USD/ZAR only below 14.01, stop loss 14.20 and target of 13.70.