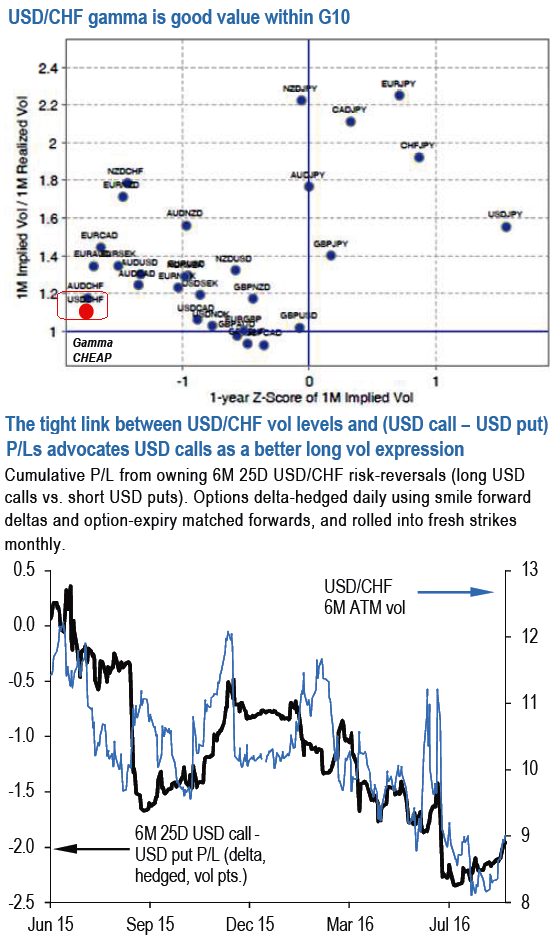

CHF is a good vol to own within G10 on gamma grounds alone (see above chart). Receptively, high-frequency realized vols have arrested their post-Brexit negative momentum and begun to turn mildly higher in August even in a broadly risk-friendly market lacking in macro catalysts.

USD/CHF is not the USD pair with the most shock value in the event of a risk market shock, as moves in the pair have increasingly become a derivative of those in EURUSD and EURCHF under the guidance of active SNB management of the Swiss Franc.

Despite this, we are comforted that CHF vs. EUR realized correlations have remained elevated at 80%, and their co-movement has been particularly strong during episodes of market stress, hence, USDCHF vol remains a credible proxy for EURUSD vol, the go-to risk hedge in FX options.

We particularly favor buying 6M USD calls/CHF puts as risk-reversals in USDCHF are priced at odds with the asymmetry of dollar risks.

USD/CHF skews trade bid for USD puts over USD calls, a concession to the traumatic franc de-peg of January 2015 and the fear of a relapse after the resumption of stealth SNB intervention. SNB's scheduled for monetary policy decision on Thursday that is likely to remain unchanged at -0.75%.

Long memory and tail risk fears are understandable aspects of option pricing, but they do mark out USDCHF as an unusual USD-pair that does not command a premium for USD calls, and where the discount for USD calls in comparison with USD puts runs counter to the valuation/positioning induced asymmetry of impulsive dollar strength but contained weakness.

Buying USD calls/CHF puts on the weak side of the risk-reversal is therefore a smile theta efficient way of gaining exposure to the market’s pain trade, and owning USD calls over USD puts has also proven to be well correlated to overall ATM levels including during episodes of vol spikes (see below chart).

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise