Ichimoku analysis (1 Hour Chart)

Tenken-Sen- 1.26394

Kijun-Sen- 1.26410

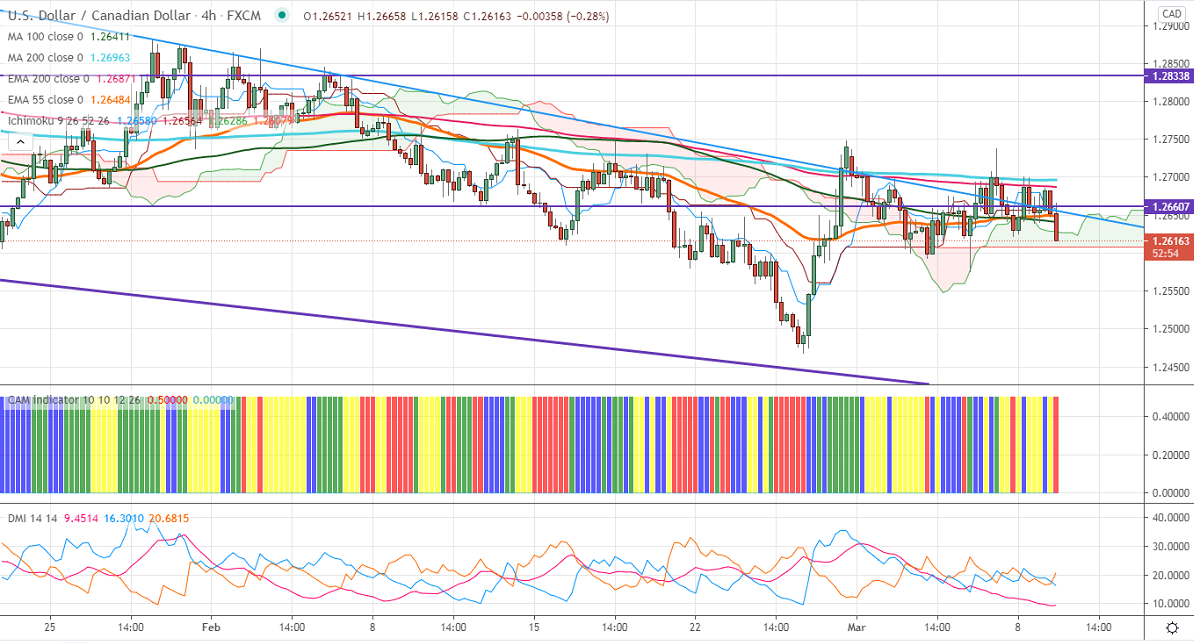

USDCAD has once again declined after showing a minor jump above the 1.2700 level. Short term trend is on the weaker side as long as resistance 1.2750 holds. The surge in crude oil prices and upbeat market sentiment is supporting the Canadian dollar. Market eyes Bank of Canada monetary policy meeting tomorrow for further direction. DXY lost 50 pips after hitting a high of 92.50. The intraday trend is on the higher side as long as support 91.60 holds. USDCAD hits an intraday low of 1.26204 and currently trading around 1.26219.

WTI crude oil declined more than $3 on profit booking after hitting two years high at $67.94. The hopes OPEC production cuts and supply disruption in Saudi are supporting oil prices at lower levels. The overall trend is bullish as long as support $62.85 holds.

Technically, the pair faces near-term resistance at 1.2750. Any indicative break above will take till 1.2800/1.2835. The significant support is around 1.2620; an indicative violation below will take to the 1.2570/1.2520.

Indicator (1 Hour chart)

CAM indicator – Bearish

Directional movement index –Bearish

It is good to sell on rallies around 1.2628-30 with SL around 1.2660 for a TP of 1.2570.