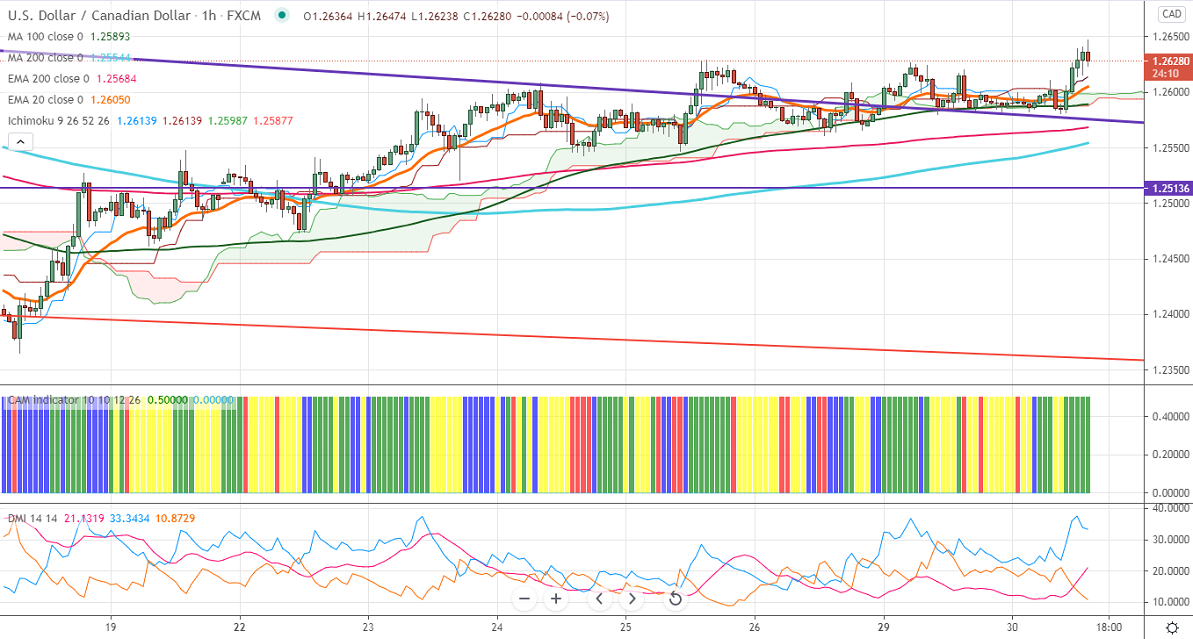

Ichimoku analysis (1-Hour Chart)

Tenken-Sen- 1.26106

Kijun-Sen- 1.26106

USDCAD is trading higher and hits one week high on broad-based US dollar buying. The surge in US bond yield is supporting the US dollar index. The US 10-year yield jumped more than 7% from a low of 1.634% made yesterday. DXY continues to trade higher and breaks significant barrier 93 levels. A jump to 93.690 likely.

WTI crude oil jumped above $60 as OPEC is expected to keep output stable in May month. The supply disruption due to the Suez Canal blockage is also supporting the crude oil supply. The short-term trend is bearish as long as resistance $62 holds.

Technically, the pair faces near-term resistance at 1.2660. Any indicative break above will take till 1.2700/1.2745. The significant support is around 1.2570; an indicative violation below will take to the 1.2550/1.2500/1.2460.

Indicator ( Hourly chart)

CAM indicator – Bullish

Directional movement index –Bullish

It is good to buy on dips around 1.2600 with SL around 1.2550 for a TP of 1.2745.