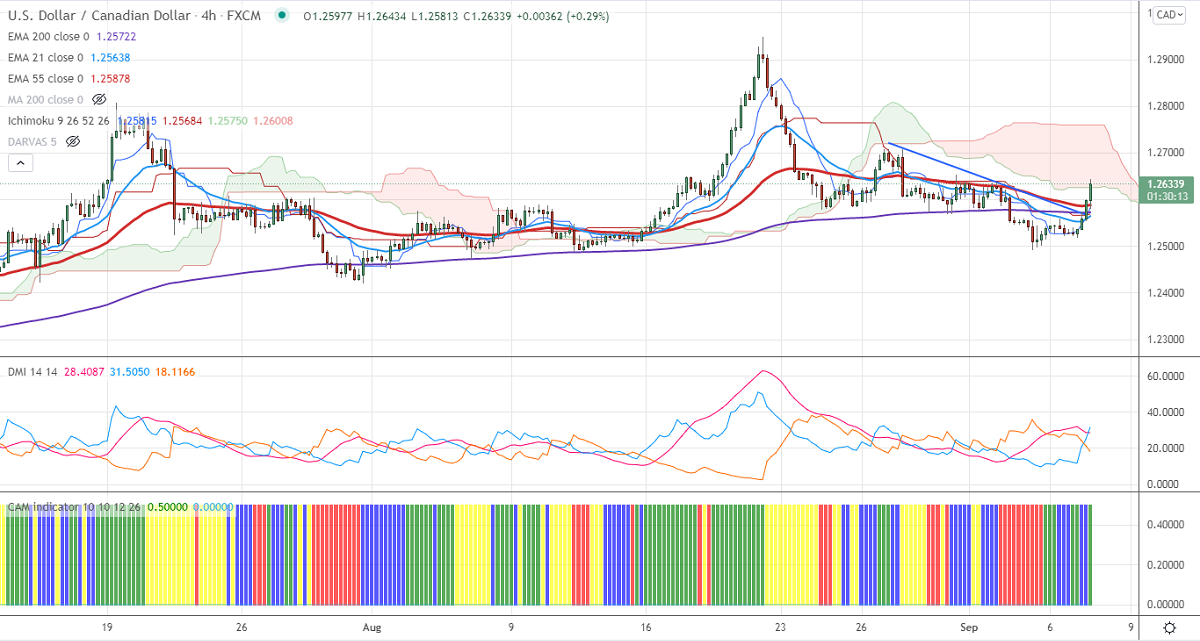

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.25596

Kijun-Sen- 1.25658

The pair has shown a pullback of more than 130 pips from a low of 1.24934. It hits an intraday high of 1.26434 and is currently trading around 1.26327. The overall trend remains bullish as long as support 1.2490 holds.

The reasons for the jump are

The minor decline in WTI crude oil prices is due to the spread of the delta variant.

The rebound of US treasury yields also supporting the US dollar index at lower levels.

Intraday Trend –Bullish

The near-term resistance is around 1.2660, a breach above targets 1.2720 (38.2% fib)/1.2760/1.28090. On the lower side, immediate support stands around 1.25980; violation below will take the pair down to the next level 1.2570 (200-4H EMA)/1.2500.

It is good to buy on dips around 1.26000 with SL around 1.25480 for a TP of 1.2760.