FxWirePro- USDCAD trades above 1.2600 levels, good buy on dips

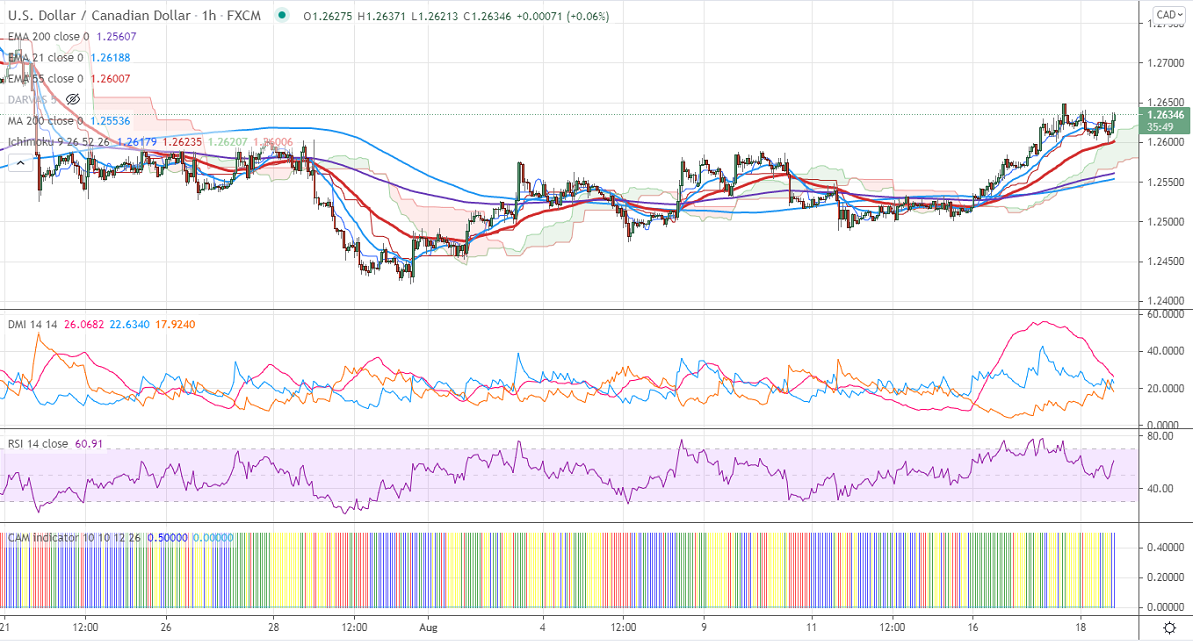

Ichimoku analysis (Hourly chart)

Tenken-Sen- 1.26179

Kijun-Sen- 1.26235

The pair continues to trade higher for the past three days and surged more than 100 pips. The reasons for the jump are

Strong US dollar

Weak Crude oil price

USDCAD declined below 1.2600 levels after upbeat Canadian CPI data. The inflation m/m for July came at 0.6% compared to a forecast of 0.3%. The overall trend remains bullish as long as support 1.25000 holds.

Trend –Bullish

The near-term resistance is around 1.2660, a breach above targets 1.2700/1.2780. On the lower side, immediate support stands around 1.2598; violation below will take the pair down to the next level 1.25545/1.2500.

It is good to buy on dips around 1.26200 with SL around 1.2580 for TP of 1.2780.