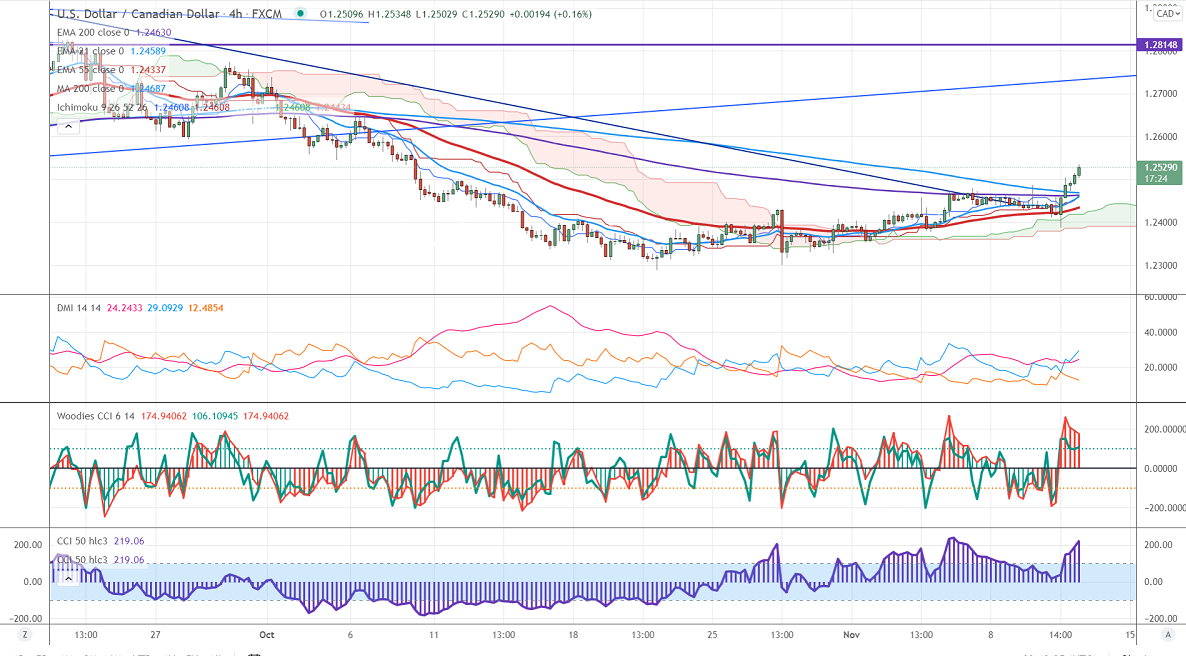

USDCAD continues to trade higher for the past one week and surged more than 250 pips on board-based US dollar buying. The US dollar index surged after upbeat US CPI data. It rose 0.9% in October compared to a forecast of 0.90% The 12-month inflation surged to 6.2%, the biggest gain since 1990. The number of people who have filed for unemployment benefits fell by 4000 last week to 267000, the lowest level since the pandemic. The minor weakness in crude oil on surging coronavirus cases in Europe is supporting the Canadian dollar at lower levels. The overall trend is still bullish as long as support 1.2280 holds.

On the flip side, immediate support stands at 1.2460 and any indicative break below that level will drag the pair down till 1.2400/1.2380.

The pair's near-term resistance is around 1.2560, any breach above targets 1.2600/1.2660/1.27010.

It is good to buy on dips around 1.2500 with SL around 1.2460 for the TP of 1.2600.