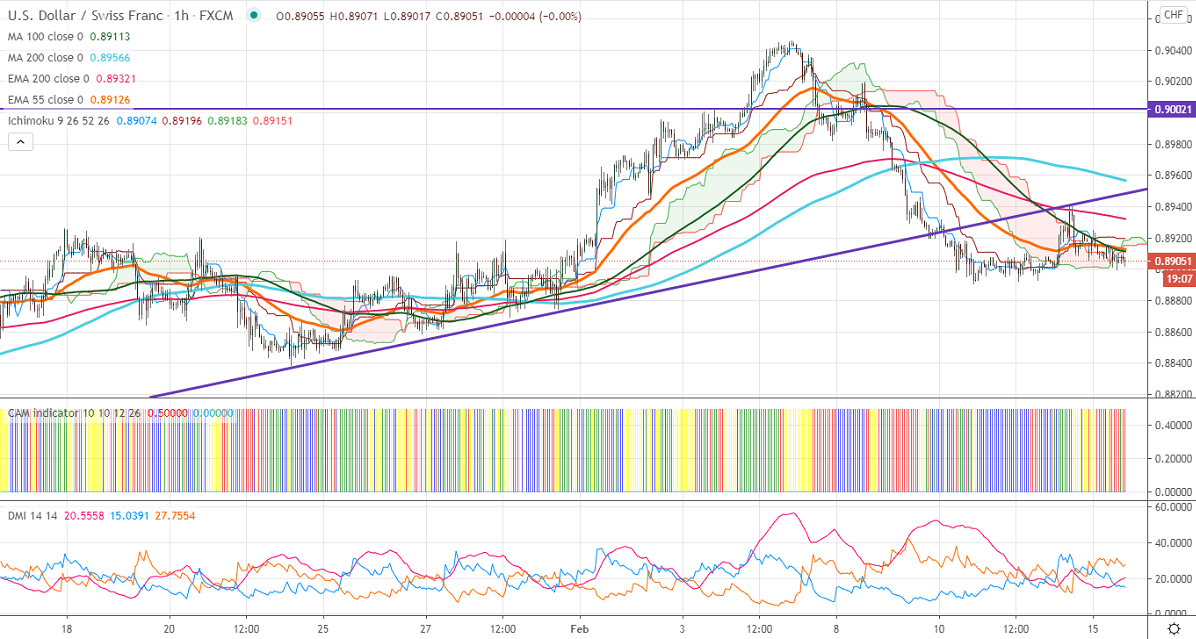

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 0.89067

Kijun-Sen- 0.89189

USDCHF has declined after a minor jump to 0.89398 level. The overall trend is weak as long as resistance 0.90440 holds. The upbeat market sentiment due to progress in the coronavirus vaccine and hopes of more US stimulus is putting pressure on the US dollar. The pair is holding well below the hourly long term moving average (200 MA) and is currently trading around 0.89061. The sharp jump in US10-year bond yields rose more than 3.8% is supporting the US dollar at lower levels. US dollar index has formed a double bottom around 90.25 and shown a recovery till 90.40.

The near-term resistance at 0.8940; any convincing violation above will take to the next level till 0.8965 (200-H MA)/0.9000/0.9044.

On the lower side, significant support stands at 0.8890, any indicative break below targets 0.88380/0.8800/0.8750.

Indicator (1-hour chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 0.8928-30 with SL around 0.8965 for a TP of 0.0.8835.