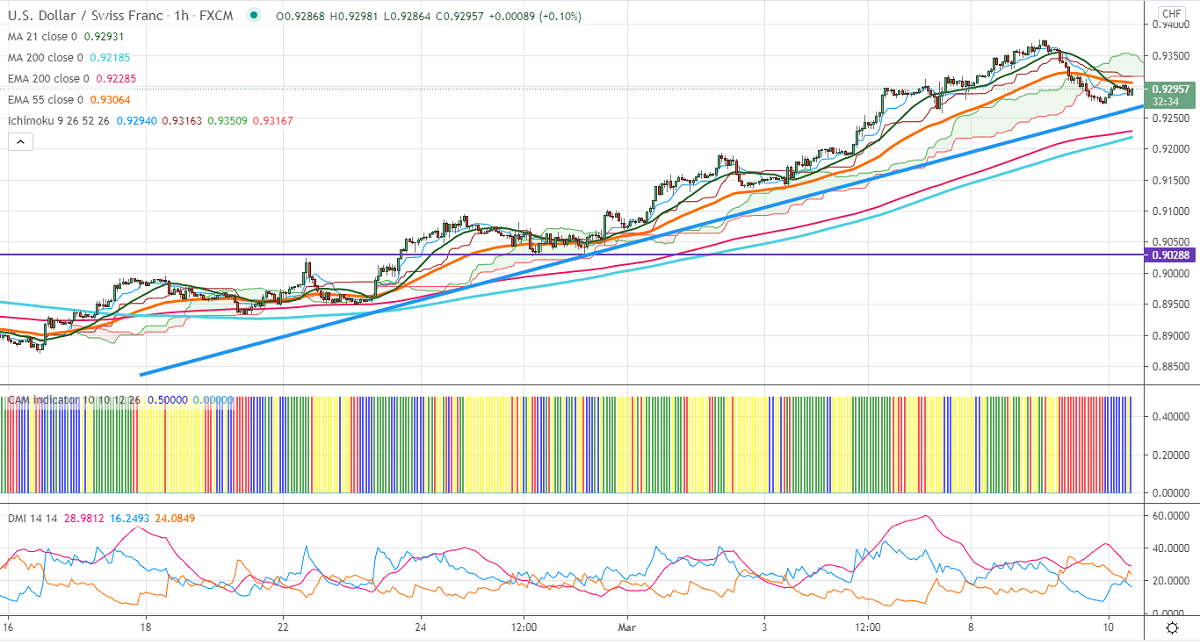

Ichimoku analysis (Hourly chart)

Tenken-Sen- 0.92901

Kijun-Sen- 0.93163

USDCHF is trading weak for the second consecutive days after forming a top around 0.9370. The US dollar is under pressure ahead of CPI data and bond auction. The intraday trend is on the lower side as long as resistance 0.9380 holds. The slight decline in US bond yield is putting pressure on the pair at higher levels. The pair hits an intraday low of 0.92864 and is currently trading around 0.92905.

The pair is facing significant resistance at 0.9380, this confirms minor bullishness. A jump till 0.9420/0.9460 likely. On the lower side, significant support stands at 0.9300, any indicative break below targets 0.9260/0.9220/0.91440.

Ichimoku Analysis- The pair is trading below Kijun-Sen and cloud bottom. This confirms minor weakness, a dip to 0.9220 is possible.

Indicator (Hourly chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell on rallies around 0.9318-20 with SL around 0.9380 for a TP of 0.9225.