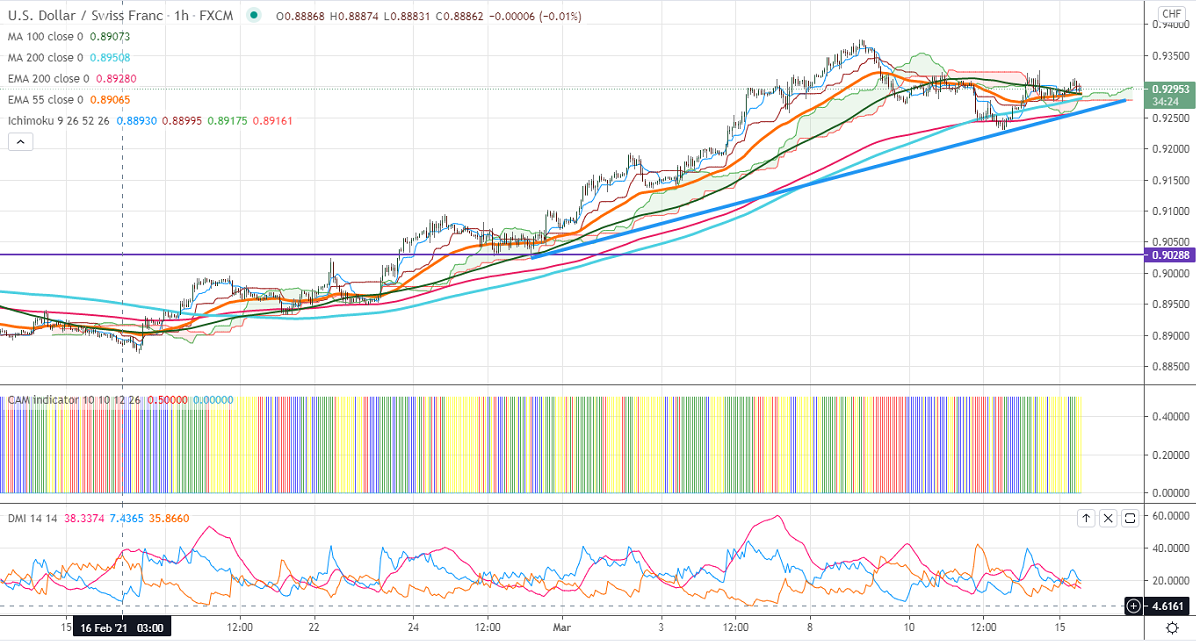

Ichimoku analysis (Hourly chart)

Tenken-Sen- 0.92944

Kijun-Sen- 0.93002

USDCHF is consolidating in a narrow range between 0.92314 and 0.93215 for the past three days. The pair recovered after a minor decline below 200-H MA. Short term trend is bullish as long as support 0.92250 holds. The surge in US bond yield is supporting the pair at lower levels. US producer price rose 0.5% in Feb slightly better than forecast 0.4%. The inflation in Jan surged sharply to 1.3%, the highest since 2009. The University of Michigan consumer sentiment rose to 83 from 76.80 in Feb. The pair hits an intraday low of 0.93123 and is currently trading around 0.932961.

The pair is facing significant resistance at 0.9320, this confirms intraday bullishness. A jump till 0.9365/0.9380. On the lower side, significant support stands at 0.9260, any indicative break below targets 0.9220/0.91440.

Ichimoku Analysis- The pair is trading above Kijun-Sen, Tenken-Sen, and cloud. This confirms minor bullishness.

Indicator (Hourly chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to buy on dips around 0.9268-70 with SL around 0.9225 for a TP of 0.9375.