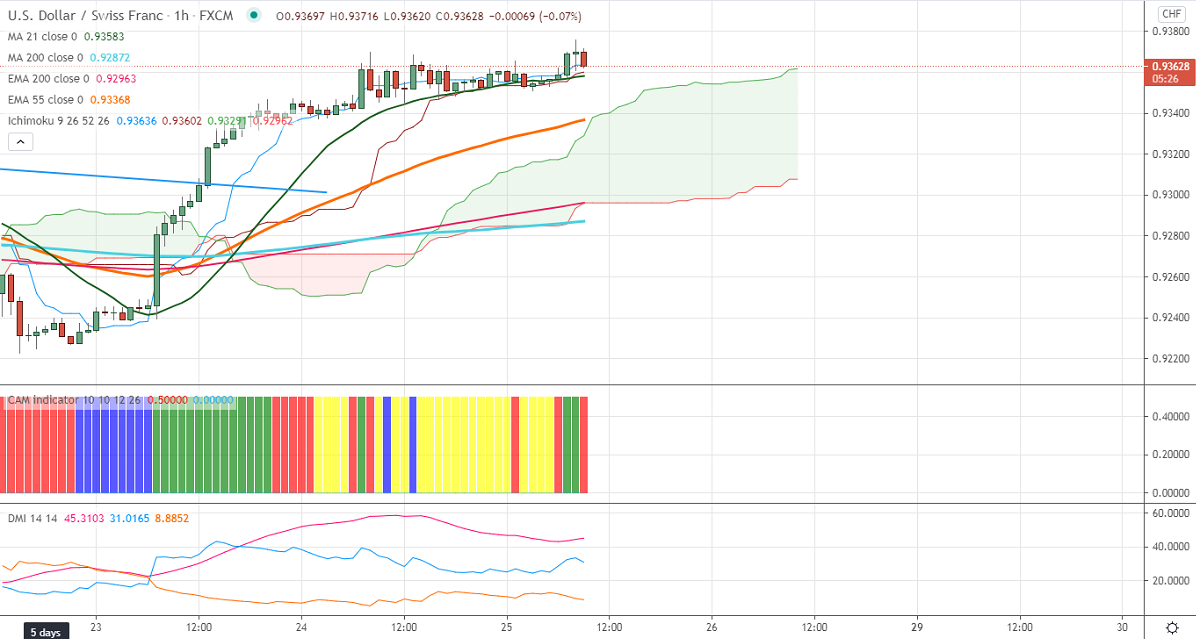

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.93636

Kijun-Sen- 0.93592

USDCHF continues to trade higher for the past three days and jumped more than 1.5% on broad-based US dollar buying. The Swiss National bank has kept its rates unchanged at -0.75% as expected. The central bank said it is ready to intervene in forex markets despite weakness in the Swiss franc. The demand for Safe-haven increased slightly after the extension of lockdown in Germany and the Netherlands and the slow rollout of the vaccine. The DXY is holding above 92.50. Significant trend continuation only if it breaks 92.70 (200- day EMA).USDCHF hits an intraday high of 0.93760 and is currently trading around 0.93668.

The pair is facing significant resistance at 0.9375 (Mar 9th, 2021); a jump past this level confirms intraday bullishness. A jump till 0.94235/0.9460. On the lower side, significant support stands at 0.9320, any indicative break below targets 0.9260/0.9200/0.9150/0.9100.

Ichimoku Analysis- The pair is trading slightly above Kijun-Sen, Tenken-Sen, and cloud. But it should close above 0.9380 for major bullishness.

Indicator (4-hour chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to buy on dips around 0.9345-80 with SL around 0.9300 for a TP of 0.94650.