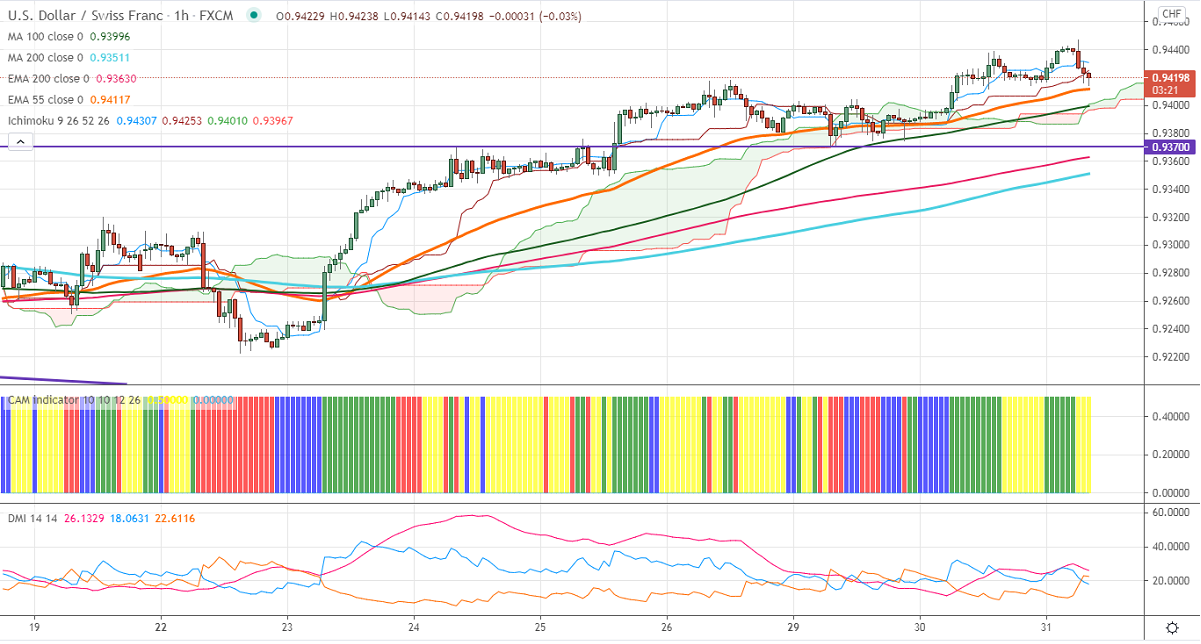

Ichimoku analysis (1-hour chart)

Tenken-Sen- 0.94316

Kijun-Sen- 0.94219

USDCHF has halted its five days of the bullish trend and shown a minor profit booking. The pair was one of the best performers in past one week and jumped more than 200 pips on broad-based US dollar buying. The US 10-year bond yield jumped more than 10% from a low of 1.59% made on Mar 24th, 2021. The surge in US bond yield and upbeat US economic data is supporting the US dollar index. US dollar index is trading higher and hits the highest level since November 2020. A strong close above 200-day EMA confirms trend continuation; a jump till 94.30 is possible. USDCHF hits an intraday high of 0.94497 and is currently trading around 0.94178.

Markets eye US ADP employment and pending home sales data for further direction. The Conference Board Consumer confidence came at 109.70 in Mar, the highest level in one year.

The pair is facing significant resistance at 0.9465 (61.8% fib 0.9900 and 0.87545); a violation above this confirms further bullishness. A jump till 0.94715/0.9500. On the lower side, significant support stands at 0.9370, any indicative break below targets 0.9300/0.9260/0.9200.

Ichimoku Analysis- The pair is trading below hourly Kijun-Sen, Tenken-Sen, and cloud. Minor weakness only if it breaks 0.9350.

Indicator (1-hour chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to buy on dips around 0.9415-17 with SL around 0.937 for a TP of 0.95000