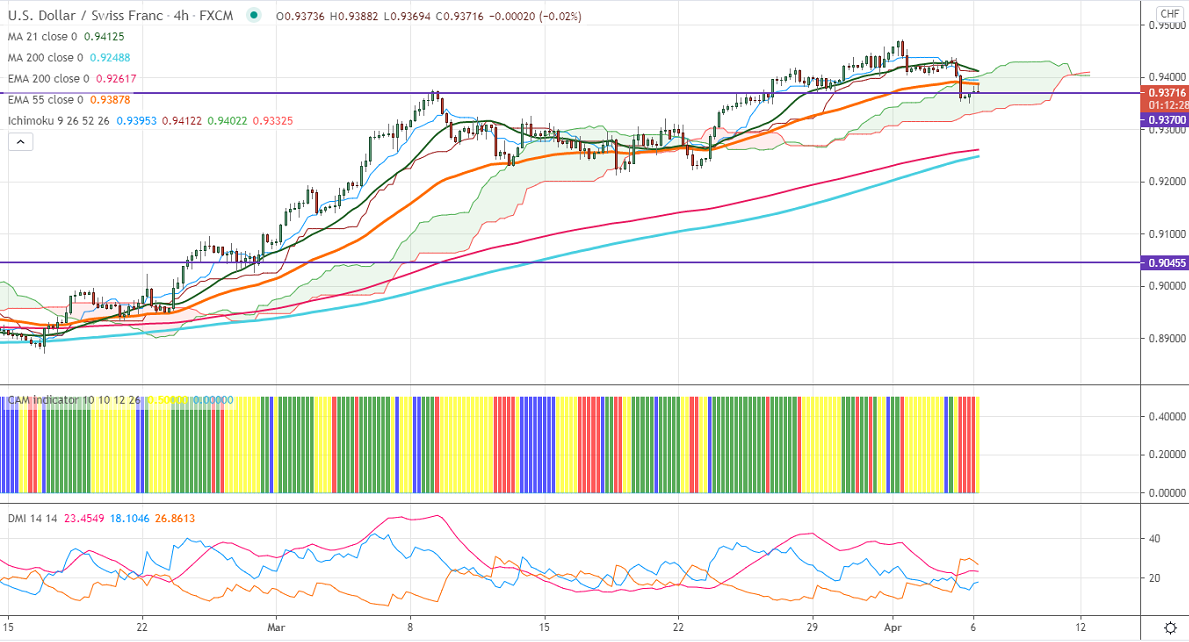

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.93953

Kijun-Sen- 0.94122

USDCHF has declined more than 130 pips after an 8-month high. The slight weakness in the US dollar is dragging the pair down. DXY has halted its 6-week of the bullish trend and lost more than 100 pips. The minor sell-off in US bond yield is also putting pressure on the US dollar. US ISM services surged to a record high in Mar due to upbeat growth in new orders. It came at 63.7comapred to a forecast of 58.3. USDCHF hits an intraday low of 0.93506 and is currently trading around 0.93745.

The pair is facing significant resistance at 0.9420; a violation above this confirms intraday bullishness. A jump till 0.9450/0.94725likely. Significant trend continuation only if it breaks 0.94725. On the lower side, significant support stands at 0.9350, any indicative break below targets 0.9300/0.9260/0.9200.

Ichimoku Analysis- The pair is trading below 4-hour Kijun-Sen, Tenken-Sen, and cloud. Minor weakness only if it breaks 0.9350.

Indicator (4-hour chart)

CAM indicator – Bearish

Directional movement index – bearish

It is good to sell on rallies around 0.9408-10 with SL around 0.9450 for a TP of 0.93000.