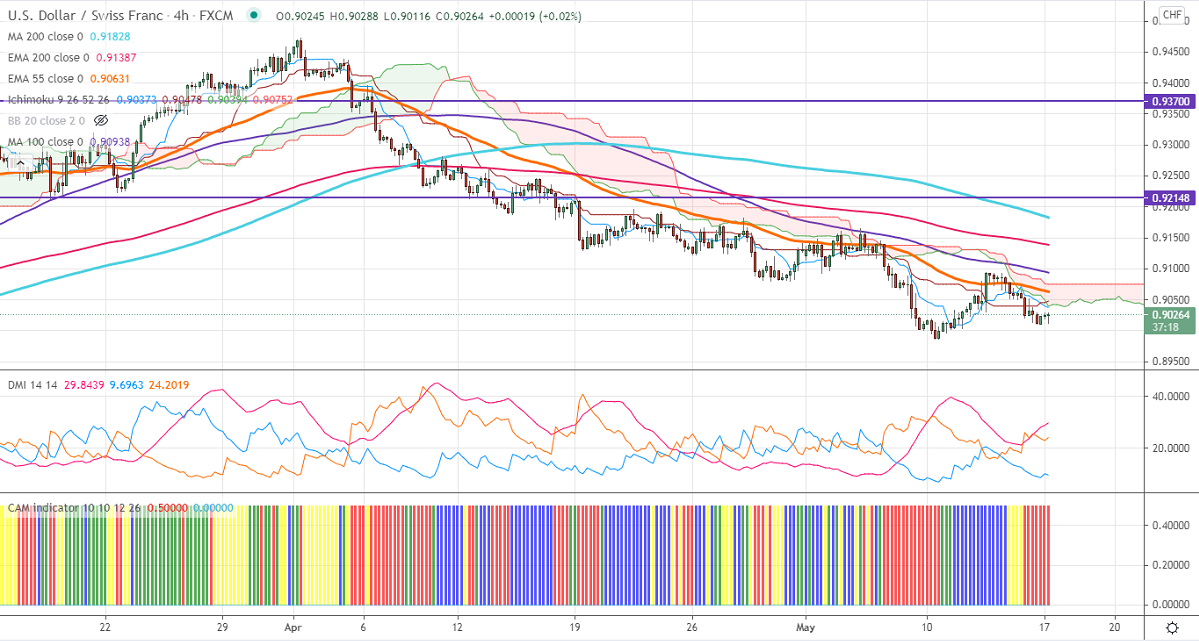

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.92292

Kijun-Sen- 0.91151

USDCHF continues to trade weak for a fifth consecutive week and lost more than 500 pips on broad-based US dollar selling. The intraday trend is weak as long as resistance 0.9060 holds. The US dollar has once again declined after a minor pullback. The index should break above 91.50 for further bullishness. The US retail sales came unchanged at 0.0% in Apr compared to a huge jump of 10.7% the previous month. The core retail sales dropped to -0.8% vs an estimate of -0.5%. The US 10-year yield lost more than 85% from a high of 1.705% made on May 12th, 2021. The long-term trend is still on the downside as long as resistance 0.94725 holds.

Intraday day outlook:

Trend- Bearish

The pair is holding well below Tenken-Sen and Kijun-Sen. The pair should break above 0.9060 for further intraday bullishness. Any jump above 0.9060 will take the pair to next level to 0.91025/0.9120/0.9165. On the lower side, near-term support is around 0.8980. Any dip below that level targets 0.8870/0.8830/0.8750.

Indicator (4-Hour chart)

CAM indicator – Bearish

Directional movement index – bearish

It is good to sell on rallies around 0.9048-50 with SL around 0.9090 for a TP of 0.0.8850.