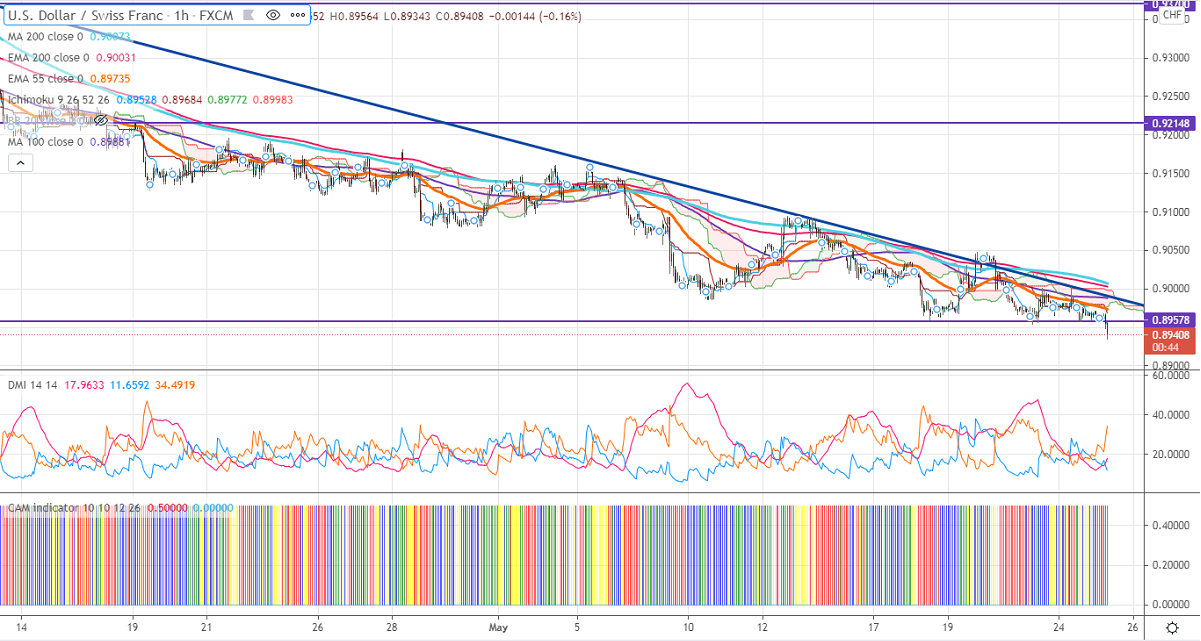

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.89528

Kijun-Sen- 0.89684

USDCHF is trading lower and lost more than 30 pips from an intraday high of 0.89680. It hits a 13-week low on board-based US dollar selling. DXY is holding well below 90 levels, a dip to 89.20 is possible. The decline in US bond yields is also putting pressure on this pair. The US 10-year bond yield lost more than 6% from minor top 1.6902%. The intraday trend is weak as long as resistance 0.9000 holds. The long-term trend is still on the downside as long as resistance 0.94725 holds. Markets eye US Conference board Consumer confidence data for further direction.

Intraday day outlook:

Trend- Bearish

The pair is holding well below one Hour Kijun-Sen, Tenken-Sen, and cloud. The near-term support is around 0.8920. Any close below 0.8920 will take the pair to next level to 0.8900/0.8870/0.8835. On the higher side, near-term resistance is around 0.9000. Any breach above targets 0.9040/0.9075.

Indicator (1-Hour chart)

CAM indicator – Bearish

Directional movement index – bearish

It is good to sell on rallies around 0.9018-20 with SL around 0.9050 for a TP of 0.8900.