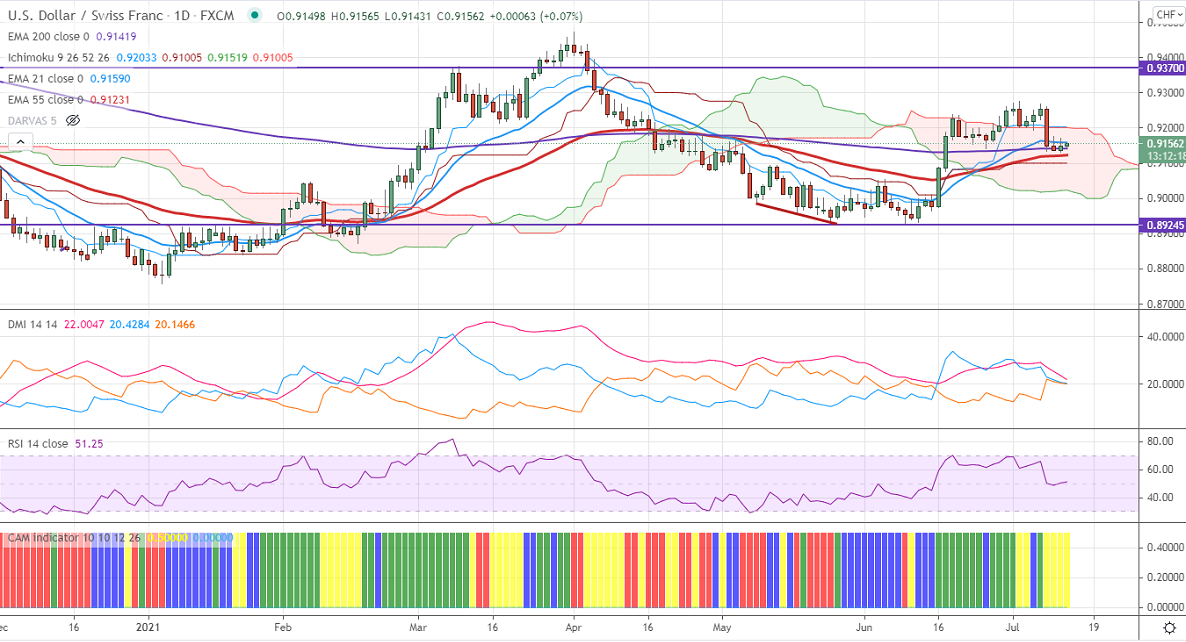

Ichimoku analysis (Daily chart)

Tenken-Sen- 0.92033

Kijun-Sen- 0.91005

Previous week High– 0.92676

Previous week low- 0.91330

The pair has shown a minor recovery after hitting a low of 0.91319. The overall trend is still bearish as long as resistance 0.92750 holds. The surge in the corona delta variant has increased demand for safe-haven assets like Yen and Swiss franc. Markets eye US CPI data today for further direction. The US 10-year yield trades steadily ahead of the US inflation report.

Trend- Bearish

The near-term support is around 0.91219, the breach below will take the pair to 0.9059/0.9000. On the higher side, immediate resistance is around 0.9180. Any convincing breach above targets 0.9238/0.92750.

Indicator (1 Hour chart)

CAM indicator – Neutral

Directional movement index –Neutral

It is good to sell on rallies around 0.91580-60 with SL around 0.9210 for a TP of 0.9050.