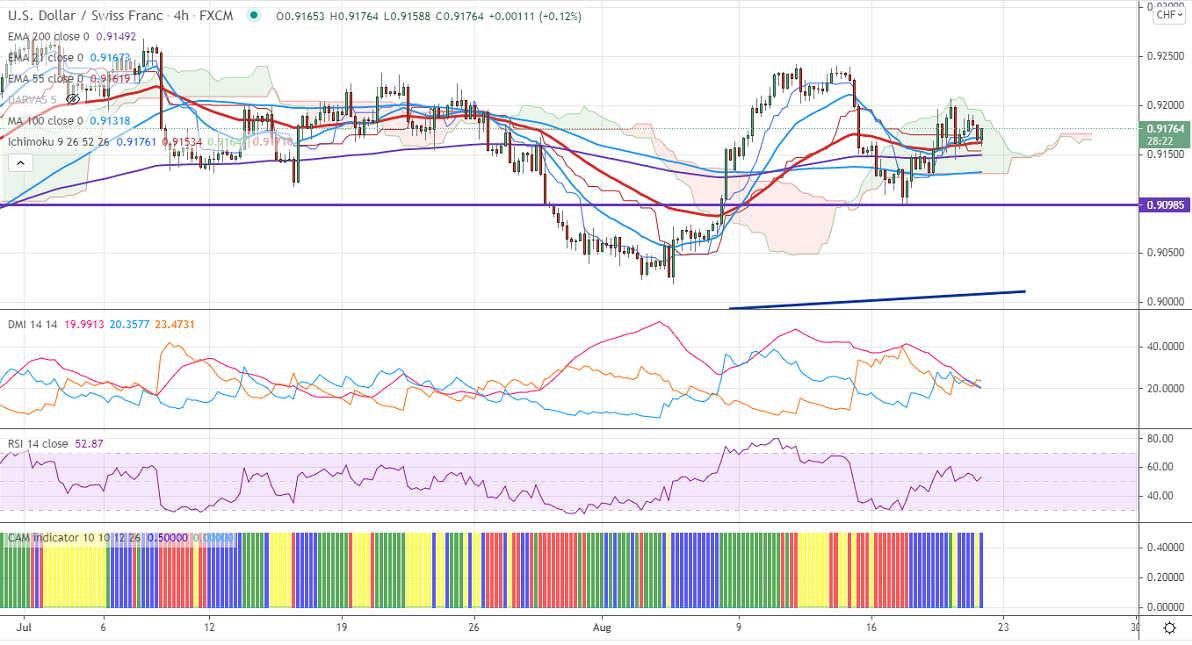

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 0.91761

Kijun-Sen- 0.91534

June month high– 0.92750

The pair is consolidating after a minor pullback to 0.92069. The increase of risk aversion is supporting the Swiss franc from further sell-off. The Philly Fed manufacturing index fell to 19.4 compared to a forecast of 23.20, the lowest level since December. The number of people who have filed for unemployment benefits declined by 29000 to 348000, a 17-month low. The Yen, Swiss franc, and Dollar are the strongest currencies this week as the spread of delta variant and Afghanistan political crisis. At the time of writing, USDCHF is hovering around 0.91633, down 0.23%.

Trend- Neutral

The near-term resistance is around 0.9025, any breach above targets 0.9240/0.9275. Bullish trend continuation only if it breaks 0.92750. On the lower side, immediate support is around 0.9150. Any convincing breach below will take to the next level 0.91150/0.90750/0.9050.

.

Indicator (4-Hour chart)

CAM indicator –Neutral

Directional movement index –Neutral

It is good to sell on rallies around 0.9218-20 with SL around 0.92750 for a TP of 0.90750.