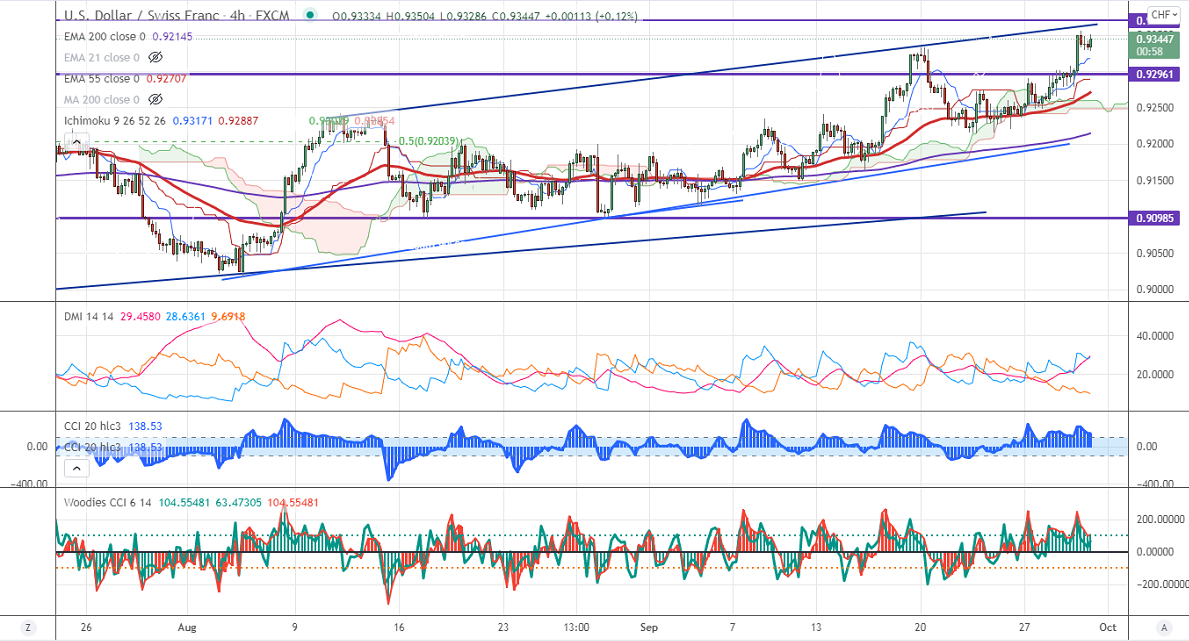

Major Intraday resistance -0.9350

Intraday support- 0.9300

The pair surged more than 80 pips from the low of 0.92789 on board-based US dollar buying. It hits a multi-month high at 0.93552 and is currently trading around 0.93444. The short-term trend is bullish as long as support 0.92750 holds. The hopes of QE tapering by the Fed are pushing the US dollar higher. The US dollar index is trading above 94. Any breach above 94.50 confirms further bullishness. At the time of writing, USDCHF is hovering around 0.93435 up 0.08%.

Woodies and CCI analysis-

Both CCI (50) and Woodies CCI is trading above the zero lines (bullish trend).

In Woodies CCI six consecutive bars close above zero lines. (Bullish trend).

Trend-Bullish

USDCHF is trading above 0.9330 and this confirms intraday bullishness. A jump to 0.9400/0.94725 is possible. On the lower side, immediate support is around 0.9275. Any convincing breach below targets 0.92150/0.9180.

Indicator (4-hour chart)

Directional movement index –Bullish

It is good to buy on dips around 0.9320 with SL around 0.9270 for a TP of 0.9400/0.9425.