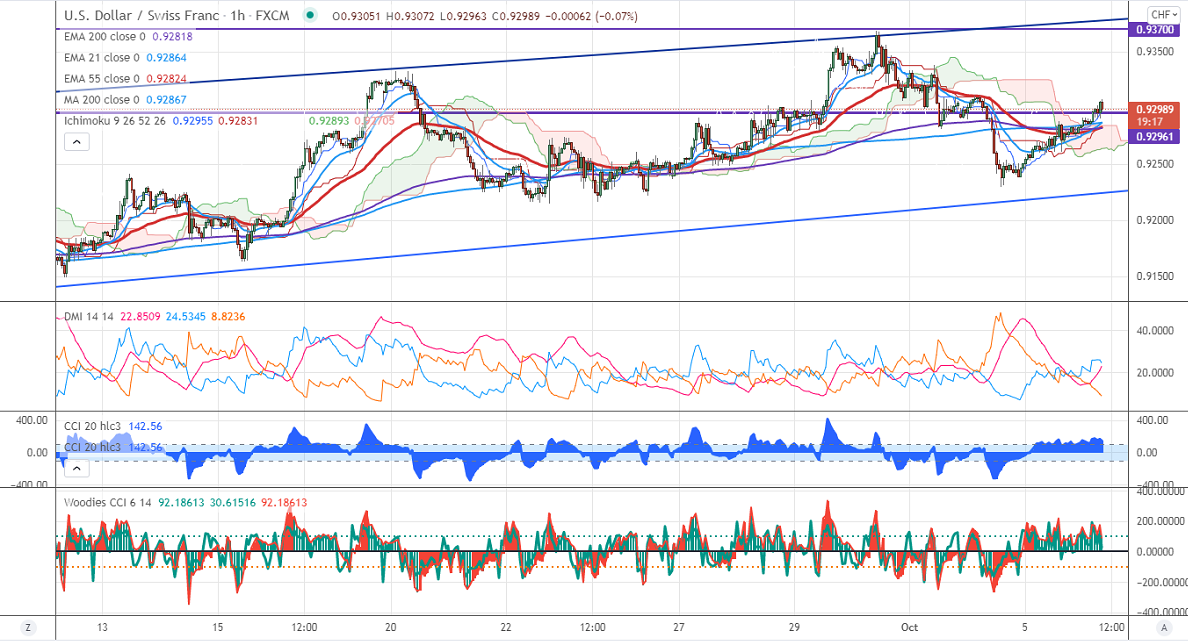

Major Intraday resistance -0.9320

Intraday support- 0.92350

The pair is trading higher for the second consecutive day and jumped more than 70 pips on the strong US dollar. The US dollar index gained above 94 levels, any breach above 94.50 confirms further bearishness. The intraday trend is still bullish as long as support 0.92150 holds. The surge in US treasury yields and the debt ceiling is supporting the US dollar at lower levels. At the time of writing, USDCHF is hovering around 0.93047 up 0.30%.

Woodies and CCI analysis-

The Woodies CC and CCI (50) are trading above zero lines (bullish trend). In Woodies CCI six consecutive bars above zero confirm the uptrend.

Trend-Neutral

USDCHF is facing strong resistance around 0.9320. Any break above targets 0.9330/0.93685. It should surge past 0.9370 for further bullish continuation. A jump to 0.9400/0.94725 is possible. On the lower side, immediate support is around 0.92350. Any convincing breach below targets 0.92150/0.9180.

Indicator (1-hour chart)

Directional movement index - Bullish

It is good to buy on dips around 0.92750 with SL around 0.9230 for TP of 0.93680.