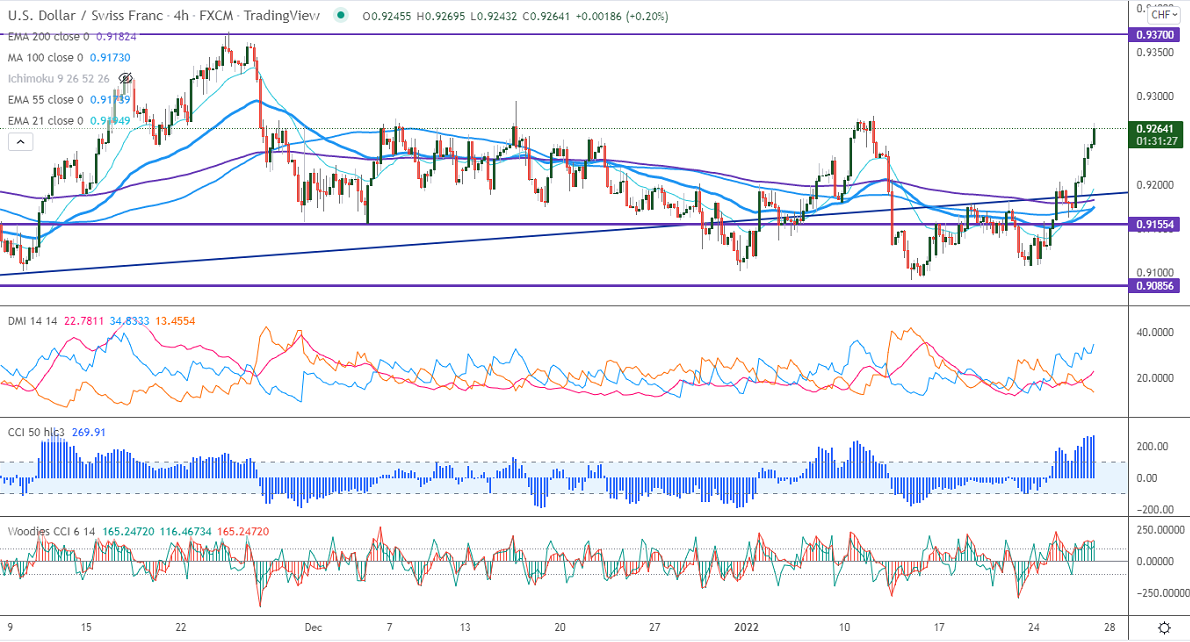

Intraday trend – Bullish

Significant intraday resistance – 0.9278

The pair regained sharply more than 100 pips after hawkish Fed monetary policy. The Fed has kept its rates unchanged at 0-0.25% and asset purchases to end in early Mar. Federal Reserve chairman Powell mentioned clearly that the central bank expected to raise rates aggressively from the next Mar meeting. The US 2-year yield has shown a massive rally and hits the highest level since Feb 2020. USDCHF hits an intraday low of 0.92695 and is currently trading around 0.92646.

Bullish scenario-

The primary levels to Watch – 0.92780. Any convincing surge above confirms intraday bullishness. A jump to 0.9300/0.9330/0.9380 is possible.

Bearish scenario-

Intraday support – 0.9200. Break below that level will take the pair to 0.9150/0.9090/0.9050.

Indicators (4-Hour chart)

Directional movement index – Bullish

CCI (50) - Bullish

It is good to buy on dips around 0.9248-50 with SL around 0.9200 for TP of 0.9380.