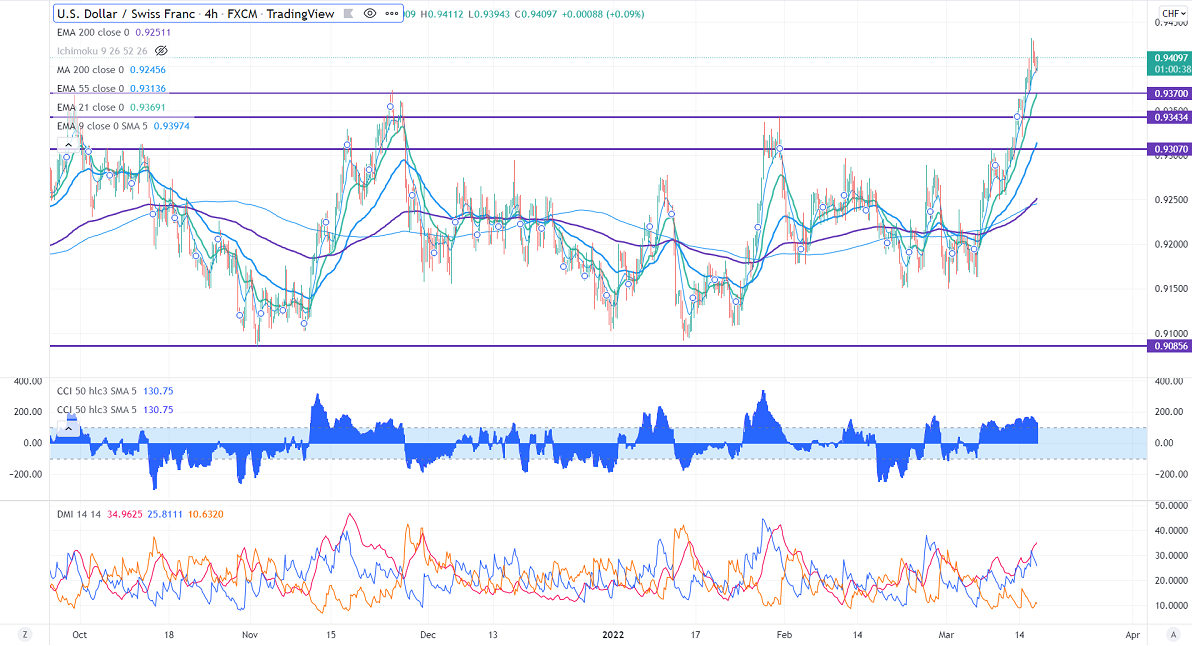

Intraday trend – Bullish

Significant intraday resistance – 0.9435

The pair surged past 0.94000 ahead of US fed policy. Fed fund futures shows that traders expect a 100% chance of a 25 bpbs rate hike in Mar meeting, 50 bpbs rate hike got reduced from 48% to 13% after Russia invaded Ukraine.Markets eye Fed Chairman speech for further direction. USDCHF hits a high of 0.94315 yesterday and is currently trading around 0.93857.

US Producer rose 0.80% MoM in Feb compared to a forecast of 1.0%.

Bullish scenario-

The primary levels to Watch – 0.9435. Any convincing surge above confirms intraday bullishness. A jump to 0.9500 is possible.

Bearish scenario-

Intraday support – 0.9370. Break below that level will take the pair to 0.9320/0.92750.

Indicators (4-Hour chart)

Directional movement index – Bullish

CCI (50) - Bullish

It is good to buy on dips around 0.9380 with SL around 0.9320 for a TP of 0.9500.